"And they all rode the ship straight to the bottom, no questions asked. Obedient corporate drones right to the very end. Those seeking to monetize poverty, were monetized by poverty."

Sinking straight to the bottom, amid continuous bullshit...

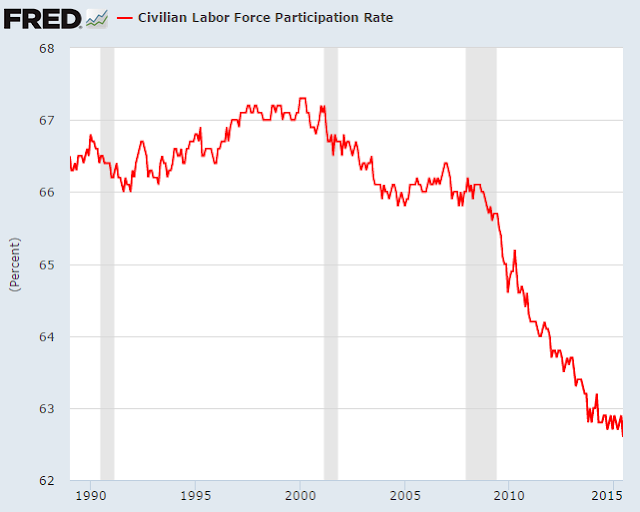

"It seemed odd, everyone 'retiring' at the same time during a recovery, but I never questioned it. I got my PhD from a Cracker Jack box"

Every job function and industry that gets outsourced comes back at 1/10th the value in global GDP as product cost gets "right-sized" down to Third World wages and profit margins.

The resulting massively bloated retail profit margins are an ephemeral illusion based upon debt accumulation...

70% profit margin:

The Globalized Ponzi scheme visualized:

Globalization separates supply from demand and brokers the difference via debt, what Bernankenstein calls the global "savings glut".

70% profit margin:

The Globalized Ponzi scheme visualized:

Globalization separates supply from demand and brokers the difference via debt, what Bernankenstein calls the global "savings glut".

No one will admit that the recurring trade deficit is the root cause of the problem:

"It seemed odd that we kept buying shit from China without ever paying them back, but I never questioned it. I thought they were just being generous"

Commonsense 101: No country can run trade deficits for 35 years straight. Trade deficits equal debt:

The cumulative U.S. trade deficit is $10 trillion over 35 years. It would be a lot higher if it wasn't for the fact that every industry that gets Walmartized, is refactored to "cost" 1/10th as much when reimported as finished goods. That's the "good news" i.e. the successful monetization of Third World slavery. The bad news is that this "refactoring" of the global economy towards the Third World has unleashed relentless uncontrolled deflation, now baselined into corporate profits while destroying middle class wages. And global GDP is of course tanking, since the developed world middle class is getting "refactored" with nothing to replace it.

Supply-side, Trickle-down, Voodoo Reaganomics led to supply with no demand

Relentless DEFLATION visualized (long-term Treasury yields):

Relentless DEFLATION visualized (long-term Treasury yields):

"At the end, the corporations monetized themselves. For fun and profit"

Each "recovery" becomes weaker and weaker as corporations respond to the lack of middle class revenue by further outsourcing the middle class. It's a downward death spiral, now featuring a corporate revenue "recession" and the largest number of self-liquidating stock buybacks in corporate history - The end game phase of liquidating balance sheet cash to create one-time fake earnings "growth".

Each "recovery" becomes weaker and weaker as corporations respond to the lack of middle class revenue by further outsourcing the middle class. It's a downward death spiral, now featuring a corporate revenue "recession" and the largest number of self-liquidating stock buybacks in corporate history - The end game phase of liquidating balance sheet cash to create one-time fake earnings "growth".

The Fed funds the casino, so billunaires and Etraders can pretend to be wealthy, while the economy gets liquidated

According to Econo-dunces, jobless "consumers" benefit from ultra low prices, despite having no incomes. Basically, the people on the top decks of this Titanic pretend that the Third World deflation rushing in via the chasmic hole in the side of the ship can be bailed out using conventional counter-cyclical tools such as Monetary and Fiscal stimulus, ad infinitum. They never stop to question why these same tools have been used for 35 years straight on an ever-increasing basis with no improvement in wages, full time jobs, trade deficits or debt levels. The only thing that goes up is fake wealth, as everything gets liquidated. The cost of capital has been stuck at zero for six years amid non-existent inflation, combined with a dearth of revenue-producing opportunities. In a middle class revenue recession , capital has no long-term investment value. The real and nominal return on capital is zero. Hence, all capital is directed towards rent-seeking, zero sum short-term speculation, and jobs automation for self-cannibalizing profit "growth".

According to Econo-dunces, jobless "consumers" benefit from ultra low prices, despite having no incomes. Basically, the people on the top decks of this Titanic pretend that the Third World deflation rushing in via the chasmic hole in the side of the ship can be bailed out using conventional counter-cyclical tools such as Monetary and Fiscal stimulus, ad infinitum. They never stop to question why these same tools have been used for 35 years straight on an ever-increasing basis with no improvement in wages, full time jobs, trade deficits or debt levels. The only thing that goes up is fake wealth, as everything gets liquidated. The cost of capital has been stuck at zero for six years amid non-existent inflation, combined with a dearth of revenue-producing opportunities. In a middle class revenue recession , capital has no long-term investment value. The real and nominal return on capital is zero. Hence, all capital is directed towards rent-seeking, zero sum short-term speculation, and jobs automation for self-cannibalizing profit "growth".

We are told that lower interest rates "help" the economy:

"It seemed odd that lower interest rates were coinciding with lower overall employment, but I never questioned it. I have an IQ lower than a fucking doorknob"

"It seemed odd that lower interest rates were coinciding with lower overall employment, but I never questioned it. I have an IQ lower than a fucking doorknob"

Interest rates with Employment-Population ratio:

Those on the bottom decks were subsumed long ago - below the water line steerage level, no voice, no representation. The people on the top decks spend all of their time and energies pretending that life on a ship keeled over at 45 degrees is perfectly normal. The band plays on. The Captain of the Titanic is changed every few years and the people on top decks pretend that the futile bailing will stop and the ship will magically right itself.

In the meantime, the Titanic continues its relentless slide into the icy abyss amid non-stop rampant lying.

In this story the Titanic blows up at the end, as $200 trillion in global fake wealth gets "refactored" for Third World returns, in real-time, a process already well advanced.

Global Dow with Global GDP (red)