Currency debasement:

The fastest way to become Third World

The fastest way to become Third World

As it was just three weeks ago, with the Halloween "Yen Massacre", now two more major Central Banks are stepping into the hardcore currency debasement war.

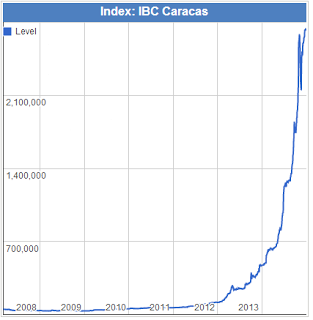

The country that "won" this pyrrhic victory in 2013 was Venezuela. The Venezuelan stock market was up 500%. All it took was 56% hyper-inflation and collapse in the currency.

Adjusting for the collapse in the currency of course, and the Venezuelan stock market went nowhere, similar to what is now happening in Japan (via ZH) where the currency adjusted return is negative.

The Euro versus Dollar: The "Plan" is working.

The Middle Class is getting decimated to benefit European speculators in non-Euro assets. Deja Vu of what is happening in Japan.

There is no hyperinflation of course in the developed world because wages are stagnant and none of the new money is making its way into the economy, it's strictly for speculators.

Smoke & Mirrors: The Canadian Illusion

Canadian stocks in U.S. dollar terms (i.e. the return a U.S. investor would receive)

Peaked in 2007:

The U.S. is the tallest midget in the circus

In the U.S. it IS different, because the currency is strengthening at the same time as the stock market. This is due to the fact that the U.S. market has now become a net receiver of liquidity from foreign central banks:

Japanese Yen (inverted) w/Dow

Elliot Wave Doesn't Work Anymore(?)

This gets back to the point of this post: Central Banks and HFT Bots didn't get the memo that Social Mood is supposed to drive the markets. Right now limitless Central Bank liquidity + HFT Momentum algorithms are putting an unstoppable bid under stocks. As I've noted many times recently, this same "process" is clearly NOT working for 85% of global markets. But it works great for the U.S.

Global Dow as a ratio of the S&P 500:

Greed Feedback Loop:

The other aspect of this latent fiasco is that now Social Mood has been driven by the stock market instead of the other way around. Investors see higher prices and then chase them even higher. Even at this late juncture, there are an overwhelming number of liars and apologists who see no problem with this situation. In the Idiocracy, Ponzinomic ideas that go on for long periods of time become sacred regardless of how badly they are doomed to end.

Social Mood Reverse Engineering:

Weekly % Bears

A $200 trillion Stampede

There are $200+ trillion of total assets globally. 85% of world markets have already rolled over. The remaining markets are levitated by HFT-drip feeds from Central Banks on multi-year low volumes.

Elliot Wave of course does still work, however, the delayed realization that all of this is history's largest con game will come as a shock and surprise to the entire planet at the exact same time.

NYSE Volume (50 Day moving average)