The "Lehman Event" was September 15th, 2008.

Which stocks peaked coincident with the end of the party last time? And which are peaking now?

Microsoft

Peaked early last time:

Perfect timing in 2008. Peaked early this time?

Northern Trust

Perfect timing in '08:

Walmart

Perfect timing in '08. A tad wobbly now...

Peaked 3 months early in 2008, but good timing in 2011. Still truckin' now (I know...)

Norfolk Southern

This is why I created this post. Good timing in 2008 and 2011 as well. Could turn out to be the best coincident indicator, only time will tell...

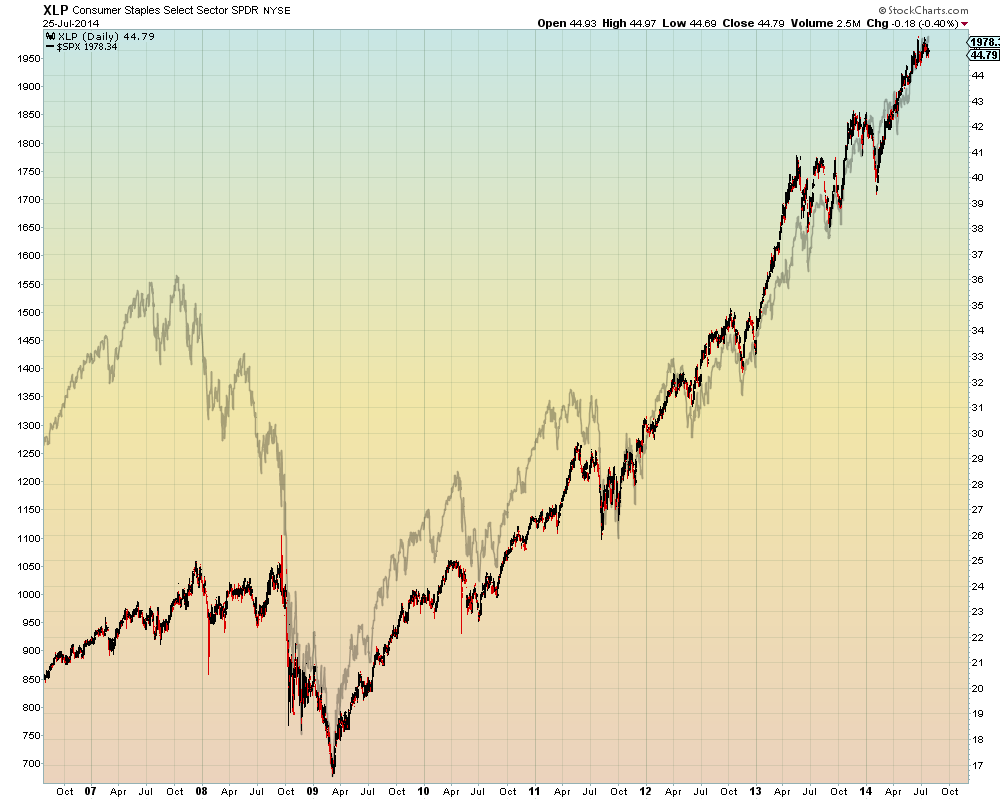

Recession stocks (consumer non-cyclical)

Perfect timing in '08. Double top in June and July so far...

JnJ

Perfect timing in '08 and 2011, looks to have peaked already now though...

Perfect timing in '08 and 2011, looks to have peaked already now though...

IPOs

A great early warning indicator - always roll over early

Treasuries are always the best early warning indicator that shit's about to break, as they were in 2007, 2008, 2010, 2011 etc. etc...