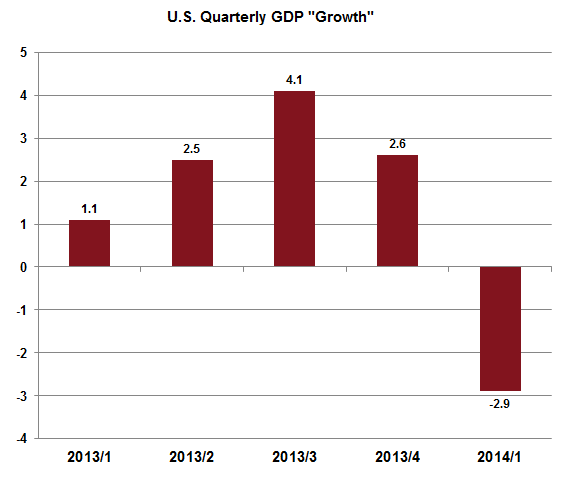

These backwards revisions to first quarter GDP are making even the buffoons look like buffoons...

Let's see, the deficit is currently running around -3%, that means honest GDP is -6% adjusting for the grandchildren's contribution to this fiasco...

Once again, T-bonds were not "in a bubble", they were merely responding rationally to forward deflation expectations which have been ongoing for 35 years and are only heading straight down as the output gap (supply-demand) explodes wider:

The Elliot Straight Down Wave:

The Potemkin Village that is the U.S. economy - supported merely by Fed money printing in conjunction with fiscal plundering of the grandchildren, can't tolerate ANY withdrawal of "stimulus". The reduction of monthly Fed bond buying from $85b/month, now down to $35b and the reduced government deficit from -10% to -3% (over five years) are now showing up in pseudo-GDP. The black line in the chart above didn't get the memo that it's heading in the wrong direction...

POSITION ACCORDINGLY.