Continually bailing out and subsidizing the Supply Side (Corporations and Lenders) while leaving the Demand Side (aka. Wage Earners, Borrowers) to flounder amidst ever-mounting liabilities is the core "strategy" of the past thirty plus years, which went into overdrive after 2008.

For a society with the intelligence of a bowl of porridge, it seems like the best option...

For a society with the intelligence of a bowl of porridge, it seems like the best option...

The very concept of separating "supply" from "demand" is at the root cause of this multi-decade fiasco, however, it gets even dumber from there...

The 35+ Year Globalization Bubble

The 35+ Year Globalization Bubble

As I just showed, this has all been one 35 year long debt-fueled bubble that started with Reagan and went parabolic into the DotCom blow-off in 2000. Econo-dunces were fooled into believing that the debt was finally coming down in 1999 because for a few months the deficit was eliminated as one-time DotCom capital gains taxes poured into Treasury. That delusion lasted about three months.

GWB - Forrest Gump for President

Bush inherited a collapsed stock market and an economy in recession and then soon after, 9/11 occurred. He took Reagan's Supply Side Economics and put it on steroids - two wars, a doubling in the defense budget, a prescription subsidy bill for geriatrics AND a massive tax cut for ultra-wealthy RomneyBots, at which point he exclaimed like the ultimate dumbfuck "We are all Keynesians Now". Meanwhile, Greenspan was doing his part post-9/11 by lowering interest rates to 1% and funding the Housing Bubble aka. the Housing ATM machine which of course collapsed in 2008.

The Bush Illusion

Bush's 8 years created zero net jobs - they were all given back during the financial crisis

The Bush Illusion

Bush's 8 years created zero net jobs - they were all given back during the financial crisis

Obama inherited the Bush-era financial crisis, so not to be outdone by Forrest Gump, he and his advisors, took Ponzinomics to "level 11" on the dumbfuck scale i.e. a doubling of the national debt (2007-2014) plus 0% interest rates, augmented by $25 trillion in global money printing. Apparently, interest rates of 0% are "1" better than the 1% rates that worked so well under Bush.

Worse yet, we live in a world in which almost all media observers, politicians, financial commentators etc. are part of the top .001% pseudo-elite. I'm not just referring to the U.S., I am referring globally. In fact there are far more well-ensconced elitists in the Third World than there are in the developed world. So these totally out-of-touch morons are literally oblivious as to how bifurcated and totally ludicrous this strategy is at this late juncture.

This entire concept of constantly bailing out and supporting Mega-corporations, Mega-banks and Mega-Lenders while leaving Wage Earners and borrowers to flounder under ever-mounting liabilities has to be the most ludicrous concept in modern history. It could never work.

Whither Hyperinflation?

Even at this late juncture, the fact that there is so much hand-wringing about the threat of "hyper-inflation" exhibits the one-sided view of today's commentators. They see a threat to their financial assets, but they have no clue as to how unsustainable this asinine gambit is on the other side of the ledger. Hyperinflation results when people have more (printed) money, and they spend it, as opposed to the current situation where people are stuck in a vise between stagnant wages and rising costs. Therefore, these elites are looking the wrong way down the railroad tracks and are blind to collapse coming from the other direction.

Post-2008, features the following wholly unsustainable costs/benefits for Borrowers versus Lenders:

"Demand Side" aka. wage earners

Stagnant Wages

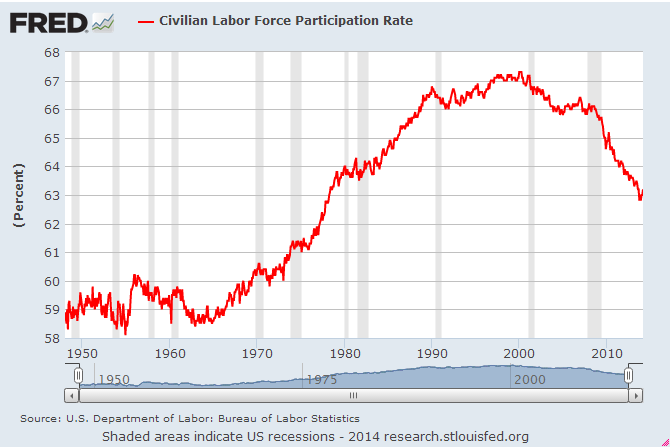

Declining Employment (% of population)

Massive legacy debts

Massive tax burden

Ever-mounting costs for healthcare, education, food and energy (crowding out other expenditures)

"Supply Side" aka. Corporations and Banks

Massively Subsidized Capital @0%

Stock market levitation via $25 trillion in global money printing

"Recapitalization of banks" i.e. using public money to fund equity in banks

Bill Gates and his fellow billionaires can thank Central Banks for their bloated wealth because without the bailout and subsequent money printing, they would be millionaires instead of billionaires. No one will need massively over-priced bloatware software on the other side of the reset.

Labor Force Non-Participation

Just today, we learned that the labor force participation rate fell to a new 35 year low, due to the fact that job creation is not keeping pace with the increase in the total population. Given that there are STILL fewer jobs than there were in 2007 and the U.S. population has grown by 12 million in the interim, it's not hard to believe:

Obamanomics: The Plan is, No Plan

Moreover, beyond the U.S., this dumbfucked one-sided bailout is a global phenomenon that is on full exhibit in some of the least solvent countries on the entire planet. Recently yields on Spanish debt have now reached levels almost as low as U.S. Treasuries, despite the fact that Spain has unemployment of 26%.

In 2011, Spain's debt to GDP ratio was 77%, today it's 105% with no ability to stop rising. The mounting burden of unemployment, fiscal austerity, legacy debts and economic stagnation is solely being placed on the broader population to the benefit of the ultra-wealthy elite who have seen their wealth soar.

Sovereign Debt is the New Subprime: When it implodes, entire nations will go belly up:

Spanish Stocks

Five Year High, Yesterday

This is dedicated to every politician, Central Bankster, billionaire and econo-dunce who actually believes that they are getting away with something. The joke will be on them.

Obama explaining his economic policies: "0% interest rates are "1" better than 1%"