The main protagonist featured in The Big Short (Michael Burry), played by Christian Bale, recently joined the bearish club saying that index funds are exhibiting the same overvaluation extreme as subprime ten years ago. Now, the same "experts" who DIDN'T see the subprime collapse coming, are criticizing the guy who DID. Why? Because there are more zombies to be harvested...

Passive indexing is a problem because it indiscriminately pushes money into an index of "stocks" allocated solely by market capitalization. The largest cap stocks continue to get more and more money making them larger in market cap, hence receiving more money. Regardless of profits or relative valuation. This crowds the market into fewer and fewer over-owned stocks. Until one day there's a massive rotation and the "momentum factor" crashes. You know, like two weeks ago.

Passive indexing is closet momentum investing because it ignores all of the central tenets of value investing. It assumes that stocks are "worth" whatever the last dunce paid for them, which is sadly not true in any market. Far worse yet, it totally ignores economic risks such as recession, and therefore creates overvaluation at a time when earnings are collapsing.

Say for example now:

But this society is 100% brain dead.

The biggest problem when momentum stocks roll over, is that they are no longer momentum stocks. Here we see that the momentum bubble has continued to grow over the past 18 months. We also see that it has peaked later and later each time:

This society outsourced all thinking to computers, to free up time for sports and entertainment. Now the Borg has the intelligence of a brick. Unfortunately, AI peaked long ago, leaving the dumb money rally running on glue fumes and semi-coherent Twitter rants.

What Wall Street is telling home gamers right now is that the inversion of the yield curve - historical harbinger of U.S. recession with 100% accuracy - doesn't matter this time around, because it just means that the rest of the world is imploding; therefore the U.S. is a safe haven. When the "TINA" safe haven trades spontaneously imploded two weeks ago, today's "advisors" somehow forgot to change the narrative.

Passive indexing is a problem because it indiscriminately pushes money into an index of "stocks" allocated solely by market capitalization. The largest cap stocks continue to get more and more money making them larger in market cap, hence receiving more money. Regardless of profits or relative valuation. This crowds the market into fewer and fewer over-owned stocks. Until one day there's a massive rotation and the "momentum factor" crashes. You know, like two weeks ago.

Passive indexing is closet momentum investing because it ignores all of the central tenets of value investing. It assumes that stocks are "worth" whatever the last dunce paid for them, which is sadly not true in any market. Far worse yet, it totally ignores economic risks such as recession, and therefore creates overvaluation at a time when earnings are collapsing.

Say for example now:

But this society is 100% brain dead.

The biggest problem when momentum stocks roll over, is that they are no longer momentum stocks. Here we see that the momentum bubble has continued to grow over the past 18 months. We also see that it has peaked later and later each time:

This society outsourced all thinking to computers, to free up time for sports and entertainment. Now the Borg has the intelligence of a brick. Unfortunately, AI peaked long ago, leaving the dumb money rally running on glue fumes and semi-coherent Twitter rants.

What Wall Street is telling home gamers right now is that the inversion of the yield curve - historical harbinger of U.S. recession with 100% accuracy - doesn't matter this time around, because it just means that the rest of the world is imploding; therefore the U.S. is a safe haven. When the "TINA" safe haven trades spontaneously imploded two weeks ago, today's "advisors" somehow forgot to change the narrative.

OECD (2019), Composite leading indicator (CLI) (indicator). doi: 10.1787/4a174487-en (Accessed on 23 September 2019)

The decoupling myth worked great last year as well, holding up through the end of September. This year it held up through the end of August:

Another lie Wall Street has been telling people, to keep them in the Trump casino, is that "stocks" do well after the Fed begins cutting rates. This is not what happened in 2007 nor 2001. Therefore they are going back more than two decades to data mine history.

Here we see that U.S. banks left the party 18 months ago:

Per the title of this post, it's telling that even as risks rise, global stocks have remain bid. Meaning the gap between fantasy and reality keeps getting wider and wider:

The momentum massacre brought hope of a rotation to value cyclicals.

A fantasy that once again did not survive the Fed meeting last week:

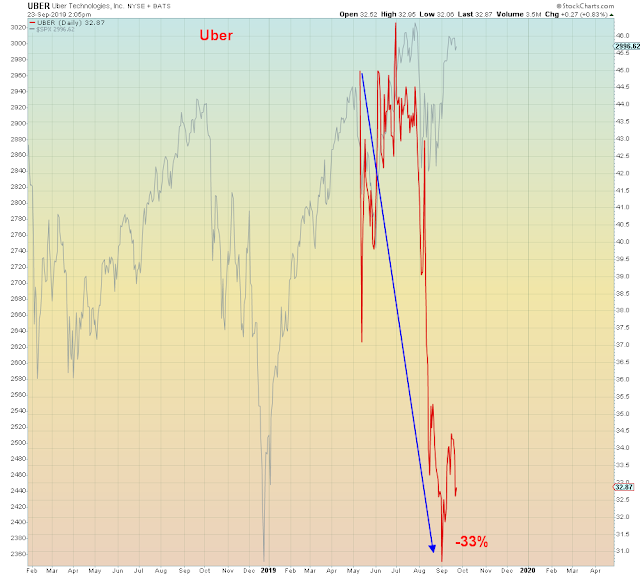

Deja vu of last year, IPOs held up into the third quarter, and are now imploding. Another successful pump and dump season is over.

Largest IPO of 2019:

Best performing IPO of 2019:

+1000% in 3 months, at the peak. Tilray was 2018's top performer.

Just waiting for Consumer Staples to roll over.

And then everything "risk" will be bidless at the same time...

"This is very much like the bubble in synthetic asset-backed CDOs before the Great Financial Crisis in that price-setting in that market was not done by fundamental security-level analysis, but by massive capital flows based on Nobel-approved models of risk that proved to be untrue"

No one ever listens to this guy. They prefer to place their trust in the exact same financial used-car-salesmen and Nobel-approved demolition experts as last time.