Global coordinated easing on a scale last seen ten years ago has sent gamblers scouring the globe for yield. Making up stories as they go. $200+ trillion worth of lies, but who's counting. Every economist, stock analyst, and pundit who isn't pounding the table bearish right now is either a total fucking moron or a criminal accomplice. This is the inconvenient end of Disney World.

"Today there is no central bank stimulus program that our Disney markets will not consider to be successful"

For a decade straight, the masses have been guzzling central bank Kool-Aid by the gallon. To the point where recession itself is now viewed as a buying opportunity. After all, what can be better for "stocks" than a reduced discount (interest) rate. Leaving aside all risk of default.

Gamblers have been well-conditioned to front-run central banks. Now, no longer even pausing to consider what would happen if central bank stimulus fails to reflate the economy.

"WASHINGTON (Reuters) - A flurry of interest rate cuts by the U.S. Federal Reserve and a host of other central banks marks the broadest shift in global monetary policy since the depths of the financial crisis in 2009"

It’s the type of coordinated change that characterized how central banks responded to the financial crisis with across-the-board rate cuts, dollar swap lines extended by the U.S. central bank to other countries, and a series of other exceptional steps to keep the world economy afloat."

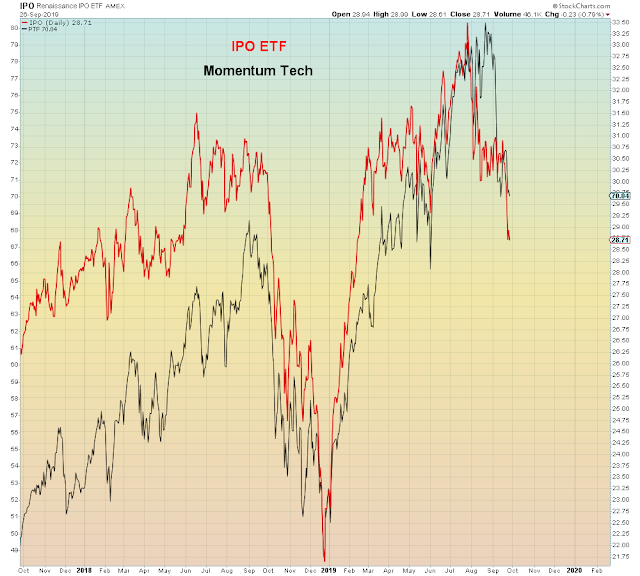

On the chart below we see the problem:

This has been a larger coordinated easing than what took place in 2016, yet German yields are still near record lows. European economic data continues to deteriorate. Meanwhile, gamblers have been front-running central banks all year long, whereas in 2016, they didn't start buying until the coordinated easing took place:

“Monetary policy has its limitations and we do not assume that this impulse will create additional investments, nor will it incentivize people to consume more,” he said. “Actually, it could result in a lot of uncertainty where people actually increase their savings and they will certainly not invest more.”

The amount of complacency right now is staggering, given the economic conditions, the trade war, and Brexit which reaches a critical deadline at the end of October:

"The House of Commons — one of the most venerated democratic institutions in the world — descended into an atmosphere of vitriol and disbelief, as enemies and allies alike condemned language used by Prime Minister Boris Johnson as he continues in his quest to take the United Kingdom out of the European Union by Oct. 31."

Risks have been accumulating steadily in the background. As the dominoes fall, the coiled spring winds tighter and tighter.

The burden of proof always on those of us who don't believe in money printing as the secret to effortless wealth.

Microsoft is now history's largest stock by market cap. And it's the only large Tech stock still "working"

Do you remember when Wall Street imploded the stock market in late September 2014 with the Alibaba IPO?

I do. And apparently Cramer remembers too.

Here is what he said in March of this year:

"If there isn't enough new capital that can be put into IPOs in the coming quarters, investors may start selling their existing holdings"

Ignored again.

It turns out that Jimmy Kunstler isn't the only one who is petrified of women wearing yoga pants.

He has good company with organized criminals:

"Under Trump, criminality was legalized"