Denial is by far the most profitable line of business right now. Devoted adherents are ecstatic whenever their numbers go up. Because when it comes to rejecting reality, there's strength in numbers, until the whole system blows up in your face. And no one sees it coming.

"In 2018, Fox News averaged its largest prime time audience in the 22-year history of the network"

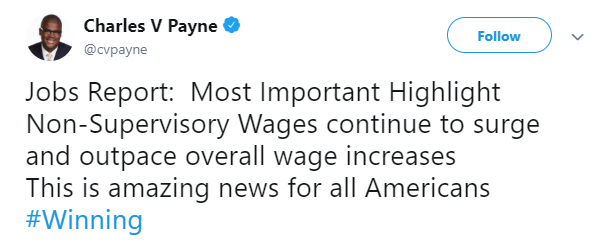

The true cost of denial will be wholly unaffordable. Right now denial addicts are being lied blind about the economy by corrupt dunces.

Biggest jobs report miss since 2008:

"Despite the jobs number, Kudlow said the U.S. economy is still on track for growth of 3 percent or more."

Picture China popping the MAGA bubble. The irony would be biblical. The global slave trade imploded by rank arrogance, learning once and for all that you can't get blood from a stone. Three overnight gaps were bought with both hands in the U.S. this week, warning that the global slave trade is ending.

One year ago the U.S. saw record inflows just prior to the global top. This time it was China's turn:

Record inflows bought a -6% haircut on the week:

This was the most under-reported financial story of 2018:

"A raft of tech IPOs have arrived on U.S. shores from China, with minimal operating histories and convoluted corporate structures"

The companies include clones of established U.S. tech companies, which are largely shut out of the China market, and can be so ridiculous that the list could be read by the Pets.com sock puppet and be taken just as seriously"

“In terms of investment, there is not one single Chinese entity that is listed outside of China in ADR or on the H.K. [Hong Kong] exchange that has a clean, legitimate set of books. Investment in any Chinese entity is therefore made at a 100% level of risk,” Dickinson said, adding that he would not even call these vehicles an “investment.”

CNBC December, 2018:

"Nasdaq, which attracted several large initial public offerings by Chinese companies this year, said it is still “rigorously” luring Asian firms to list on its exchange."

Manic gamblers conditioned by serial monetary bailouts, have been too busy front-running central banks to realize that central banks are out of economic bullets. Sure they can inflate asset bubbles for a time using cheap money, but they can't make insolvent borrowers whole when the bubbles pop.

The critical lesson not learned over the course of this lost decade: There is no such thing as "free money".

Economics 101: Crowding Out

"When the economy is operating near capacity, government borrowing to finance an increase in the deficit causes interest rates to rise."

Once upon a time America had courage, but those days are long gone. Now we have old men and Lost Boys circle jerking each other with alt-reality. Rush Limbaugh co-leading the effort to keep the Trumptopian bubble full of hot air. He and his illusory ilk are the necessary condiment to failure...

Club Orlov: License To Kill:

"George Orwell once offered an excellent explanation for this phenomenon: as the imperial end-game approaches, it becomes a matter of imperial self-preservation to breed a special-purpose ruling class—one that is incapable of understanding that the end-game is approaching"

Fifty years ago, America's achievement was launching a six million pound rocket 250,000 miles to the Moon and back at the velocity of a bullet. Now, we can share food experiences on Snapchat over the internet backbone invented in the 1960s. The question, "what the fuck happened", doesn't quite do justice.

"As of 2019, the Saturn V remains the tallest, heaviest, and most powerful (highest total impulse) rocket ever brought to operational status"

If it's embarrassing describing this shite, imagine being the sheeple drooling it up without question. The old age home has existential fear and a death grip on political power. Banana Republican Senate leader Mitch McConnell rejected the House electoral reform bill out of hand this week. He will take up the Green New Deal just to watch it fail, but he won't even consider reforming electoral corruption. He would never get elected again if he did.

Time is not on their side.

This week's shout out goes to Jeremy Grantham, a man who made a fortune, but can still tell the truth, on climate change, tax reform, and wealth inequality. Why? Because he's an order of magnitude smarter, more honest and more human than the denialist Twinkies who define this era. Human call options with imminent expiration.

I had almost forgotten what it was like to listen to a real man, and not someone whose job is to make excuses for incompetence:

"Wealth inequality in the U.S. is approaching that of countries like Brazil and Chile."

We got comically asinine economic data out of Europe, China, and the U.S. late this week. The U.S. payroll report missed consensus estimates by an order of magnitude (20k versus 180k). Afterwards, I couldn't find one link to it on the main page of CNBS. As the news broke, all of the usual economists were standing around looking like the fucking morons they were proven to be a decade ago.

As always, deflation is beating denial:

We've come to think of the Third World as an endless vessel of cheap labour, ours for the exploitation. All while blaming them for our problems. Uncontrolled deflation post-2008 proved that model wrong, as our own interest rates plummeted to 500 year lows. What did we learn? Nothing, other than recycling greater exploitation into greater deflation via another round of the Hunger Games.

Now a mere 250 basis points stand between us and them. 2.5%.

Europe is already at 0% and so is Japan. Here in the U.S., contrary to popular belief, printing money to buy stocks does not float the economy back from China. All it does is drive a bigger divergence between fantasy and reality. It sponsors delusion.

Speaking of imagined realities, it turns out that the Chinese government facilitated this week's reversal of fortune. Why?

Speaking of imagined realities, it turns out that the Chinese government facilitated this week's reversal of fortune. Why?

Because as part of the Faustian Bargain of MSCI stock inclusion, they had to agree to take a less active role in priming the stock market.

The cost of inclusion.

"Such a sell rating must have been authorized by the regulators"

"This sell rating is like a depth charge for the market"

Contrary to Zerohedge assertion, there is no plunge protection team anymore.

There is just overnight risk. OFF.

And gamblers maximum leveraged to denialistic bullshit. Having learned absolutely nothing ten years later, aside from how to operate like a Third World country.