We've been informed by the Ponzi academy that Bitcoin is illiquid by design. By coincidence so is the algo-managed Dow casino. Neither are built to scale. They were both built to handle low volumes. The minute volume spikes, they both stop working...

I've come to realize that confirmation time is more important than confirmation fee, since Bitcoin really isn't intended to buy things other than body parts and machines guns off the dark web. As always don't take my word for it, I'm expanding my education:

"Firstly BitCoin is a store of value and that's how we all want it. We want BTC price to go through the roof. Later once they sort out the off chain scaling then transactions per second can go through the roof and the fees will be low. If you feel the need to throw away your crypto on cups of coffee then get ETH or something."

Any questions? Once it goes to infinity, they'll work out the scalability kinks, when each transaction requires a nuclear reactor to complete. And if later never comes, that's ok too, as long as it goes to infinity in the meantime.

"The Bitcoin rate spike, still alive despite bitter divisions in the community that supports the cryptocurrency, has laid bare the biggest problem with Bitcoin: Compared with fiat currencies, it's painfully inconvenient and expensive to use as a means of payment."

"The Bitcoin system is designed around scarcity and its traditionalists insist on keeping the block size small"

Which brings us back to the real problem, which is liquidity or lack thereof. You see when Ponzi schemes are inflating, a lack of liquidity is a feature because it allows small transactions to move the price a lot. However, on the downside, the same is true - small transactions move the price down a lot. Let's say gamblers followed Zerohedge into the BitCasino but suddenly for whatever reason it doesn't go to infinity. Instead it's rolling over -30% every hour. Next thing you know, confirmation times are blowing out to hours, then days. What to do?

Nothing.

Getting back to the Dow, let's say gamblers spent the better part of ten years all getting on the same side of the market amid the lowest volume and volatility in casino history. Next thing you know, the Dow isn't going to infinity anymore and they want to get out. However, there's no algo on the other side of the trade, since they are by design liquidity takers, not liquidity makers. What to do?

Nothing.

Which brings us to today and the fourth down open in a row.

First off, the BTFD team is taking their ball home:

Secondly, now that the tax cut trend-line is broken, this floor is not going to last forever, especially amid imploding breadth:

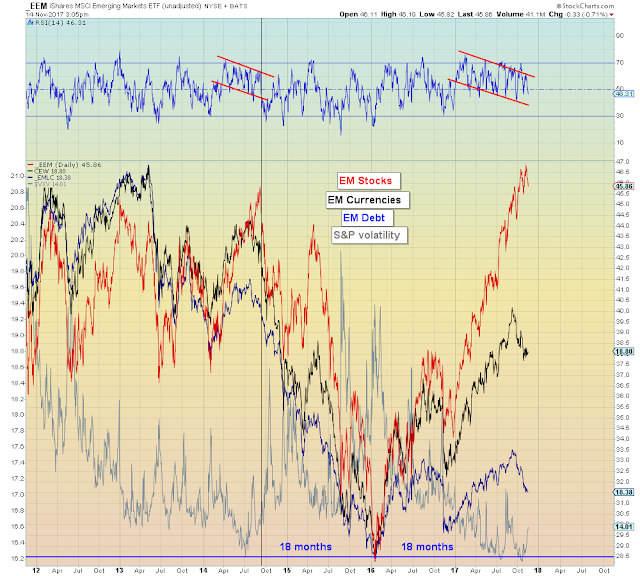

Third, the rest of the world has much more to offer in the way of downside gaps:

Fourth, the smart money has already left the casino for this cycle...

Fifth, Skynet is likely going to be heading for the exits soon. Again.

Sixth, the Fed is trying a new experiment by removing liquidity at both ends of the rate curve at the same time, for the first time in Fed history.

In summary, volume, volatility, institutional selling are all rising, and liquidity is falling: