Futures are bid after hours due to a larger than expected inventory draw (API/industry). I'll await the government provided numbers later in the week to confirm. Regardless of short-term squiggles, as long as the oil market remains in an historically unprecedented glut, oil speculators will continue to get buried by the futures contango (rollover) losses...

One wonders how much longer they can keep up this hopium based burial service...

"Thanks OPEC!"

3x leveraged oil ETF (current week volume is through today):

Last week's inventories with WTI front month:

The oil ETFs embed all futures rollover (contango) losses caused by the oil glut. In a glut, the futures curve is steeply positive.

Despite massive volume, the single leveraged ETF has gone nowhere for nine months:

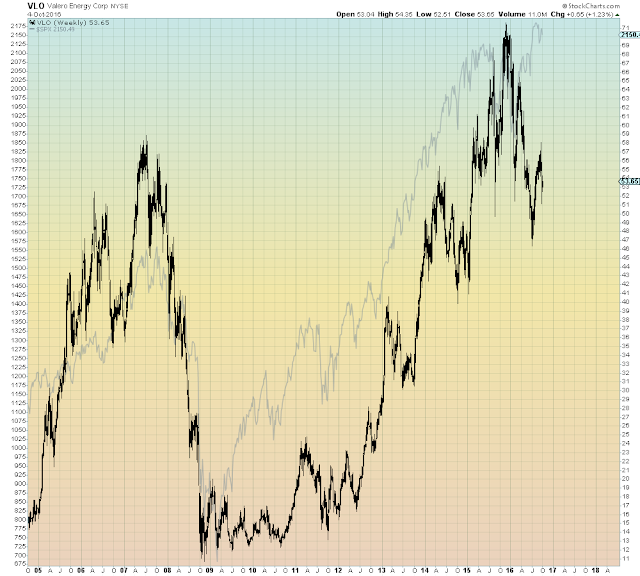

Bonus chart: Exxon aka. "Energy sector"