Meet the new oil traders:

“Y-O-F**KING-LO,” the teen wrote, flashing his trading statement. “900 to 55K in 12 days!”

"The latest obsession on WallStreetBets is UWTI, an exchange-traded note that has become a favorite of younger investors — thanks, in part, to the Reddit forum. It is a near-perfect embodiment of the YOLO spirit: Highly volatile, it uses a combination of derivatives and debt to amplify bets on oil, creating opportunities for quick profits."

ZH: May 27, 2016

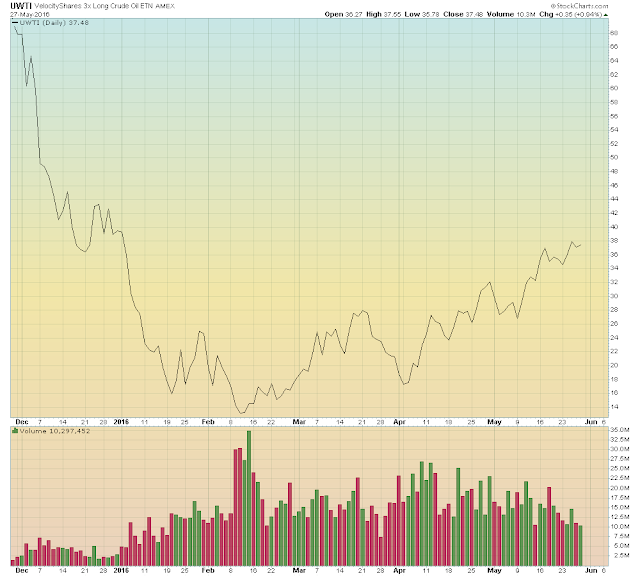

The 3x leveraged oil ETF (UWTI):

3 year (split adjusted)

Beneath this rising wedge are stop loss orders. When those get triggered, then there will be more stop loss orders etc. etc.

Cascading stop losses visualized:

(Price momentum, lower pane)

Because 1x leveraged oil futures (contango) losses are not painful enough...

USO:WTIC ratio (red line): -75%

USO ETF black line:

One year ago, day-trading Chinese housewives were going all in...

USO:WTIC ratio (red line): -75%

USO ETF black line:

One year ago, day-trading Chinese housewives were going all in...