Cash is a 4 letter word...

Rydex Money Market Fund Assets

ALL IN VISUALIZED:

Barron's: Insider Transactions

Sales / Buys

SPY 20 day volume:

"Welcome to the Hotel Californication, bitchez"

The globalized economy is a colossal Ponzi Scheme in which the vast majority survive on the bread crumbs falling off the table. The possibility of 7 billion people achieving a consumption-oriented lifestyle is zero, so the World Bank conveniently set the poverty line at $1.25/day to legalize global slavery. As long as someone else's children are doing the suffering, it's "all good". Post-2008, this illusion was extended merely by plundering all future generations.

Saturday, April 30, 2016

"It Was Smooth Sailing Right Into Disaster"

Herding the sheeple...

The past 12 weeks saw a massive rotation from growth to yield, under the premise that it's "safe"...which is a colossal trap...

In 2001-2004 the Fed induced people to load up on 1% adjustable rate mortgage debt. Then the Fed obliterated them with 17 interest rate hikes. Fast forward to now...Central Banks have systematically eliminated volatility, conning sheeple into believing they've eliminated risk...

The most lethal bubble contest continues:

China

Oil

S&P 500

Municipal Bonds...

Barron's April 30th, 2016

Is the Bull Market Running Out of Steam?

"On Monday, Atlantic City is expected to miss a $1.8 million bond payment, which would be the first default in the Garden State since the 1930s."

"That, of course, is dwarfed by the financial crisis in Puerto Rico, which faces a $422 million debt payment on Monday"

April 29th, 2016 BondBuyer

Massive Municipal Bond Inflows Continue For 30th Straight Week

"We usually don't see such consistent inflows this time of the year...inflows into municipal bond mutual funds have averaged $1.1 billion per week year to date, which is higher than recent years....Anytime you get a billion that is a big number, but to have a billion, on average, is huge,"

"No volatility means no risk"

Junk Bonds

Reuters, Mar. 3, 2016

Junk Bond Inflows Highest On Record

Dividend stocks

RISK IS BINARY

PANIC IS INEVITABLE

The past 12 weeks saw a massive rotation from growth to yield, under the premise that it's "safe"...which is a colossal trap...

In 2001-2004 the Fed induced people to load up on 1% adjustable rate mortgage debt. Then the Fed obliterated them with 17 interest rate hikes. Fast forward to now...Central Banks have systematically eliminated volatility, conning sheeple into believing they've eliminated risk...

The most lethal bubble contest continues:

China

Oil

S&P 500

Municipal Bonds...

Barron's April 30th, 2016

Is the Bull Market Running Out of Steam?

"On Monday, Atlantic City is expected to miss a $1.8 million bond payment, which would be the first default in the Garden State since the 1930s."

"That, of course, is dwarfed by the financial crisis in Puerto Rico, which faces a $422 million debt payment on Monday"

April 29th, 2016 BondBuyer

Massive Municipal Bond Inflows Continue For 30th Straight Week

"We usually don't see such consistent inflows this time of the year...inflows into municipal bond mutual funds have averaged $1.1 billion per week year to date, which is higher than recent years....Anytime you get a billion that is a big number, but to have a billion, on average, is huge,"

"No volatility means no risk"

Junk Bonds

Reuters, Mar. 3, 2016

Junk Bond Inflows Highest On Record

Dividend stocks

RISK IS BINARY

PANIC IS INEVITABLE

MAYDAY

This era is doing to capital what 2008 did to labour...

The story of this entire era is capital attempting to monetize poverty at 0%. A zero sum game, rotating between asset classes until there was nowhere left to hide...

To be sure, it took a while for reality to catch up with the *free* trade free lunch club:

The Oracle of Omaha is dispensing wisdom today:

"Folks, let's be honest, the secret to effortless wealth is printing money"

Nowhere left to hide...

Dead Presidents

The story of this entire era is capital attempting to monetize poverty at 0%. A zero sum game, rotating between asset classes until there was nowhere left to hide...

To be sure, it took a while for reality to catch up with the *free* trade free lunch club:

(VOLUME + VOLATILITY + COMPLACENCY) - LIQUIDITY = PANIC

Deflation with oil

The Oracle of Omaha is dispensing wisdom today:

"Folks, let's be honest, the secret to effortless wealth is printing money"

Nowhere left to hide...

Dead Presidents

Friday, April 29, 2016

The Day of Wreckoning

Globalization was Disneyland for yuppies and billunaires. They control the media, they control the message. Everyone else was just a commodity to be monetized...

History will not be kind to the plastic fantastic. Corporations fabricated this entire clusterfuck from end to end. It's all by and for corporate profit. They control all aspects of it from the phony governments to the phony economy, to the phony people.

Eight years of corporate shock doctrine:

We'll save the archaeologists some trouble:

By the end...

Faux News/24 hour bullshit was the main source of infotainment propaganda. Orwell's Ministry of Truth was de facto.

Reality TV predominated, devoid of all reality. The history channel was devoid of history and the Learning Channel was devoid of learning. The Matrix was complete.

Soylent junk food and junk culture were de rigueur as monocultures supplanted anything real.

The Yuppies of the day were maxed out in every direction: financially, mentally, emotionally, physically. They never saw it coming. They were the handmaidens to collapse. They even laid themselves off to make the last quarter. Ever efficient, loyal corporate bukkake whores to the very end.

Central Banks orchestrated the end game. Printing money replaced the erstwhile economy. Escalating poverty was monetized into 0% Ponzi loans as a proxy for a real economy. It was economic euthanasia.

The stock market devolved into a momentum-driven casino wholly disconnected from the outsourced economy. Stoned gamblers threw their money down a shit hole while pretending to be wealthy.

Politics devolved into the circus it aspired to be. Choosing a candidate was like playing Russian roulette with a full revolver.

University had long since devolved into a social stratification mechanism to control entry to the country club. Fraught with rampant date rape, alcoholism, rote memorization, pointless theories, all culminating in personal bankruptcy.

In lieu of personal responsibility pharmaceutical companies created chemicals to treat every symptom of a bad lifestyle. Doctors sold more narcotics than the Medellin Cartel. Pills were used to fix pills. The silver bullet was ever at hand with side effects ranging from uncontrollable diarrhea to sudden death.

Bear in mind, it all made perfect sense at the time.

Because nothing was more fake than the people who believed in all of it.

History will not be kind to the plastic fantastic. Corporations fabricated this entire clusterfuck from end to end. It's all by and for corporate profit. They control all aspects of it from the phony governments to the phony economy, to the phony people.

Eight years of corporate shock doctrine:

We'll save the archaeologists some trouble:

By the end...

Faux News/24 hour bullshit was the main source of infotainment propaganda. Orwell's Ministry of Truth was de facto.

Reality TV predominated, devoid of all reality. The history channel was devoid of history and the Learning Channel was devoid of learning. The Matrix was complete.

Soylent junk food and junk culture were de rigueur as monocultures supplanted anything real.

The Yuppies of the day were maxed out in every direction: financially, mentally, emotionally, physically. They never saw it coming. They were the handmaidens to collapse. They even laid themselves off to make the last quarter. Ever efficient, loyal corporate bukkake whores to the very end.

Central Banks orchestrated the end game. Printing money replaced the erstwhile economy. Escalating poverty was monetized into 0% Ponzi loans as a proxy for a real economy. It was economic euthanasia.

The stock market devolved into a momentum-driven casino wholly disconnected from the outsourced economy. Stoned gamblers threw their money down a shit hole while pretending to be wealthy.

Politics devolved into the circus it aspired to be. Choosing a candidate was like playing Russian roulette with a full revolver.

University had long since devolved into a social stratification mechanism to control entry to the country club. Fraught with rampant date rape, alcoholism, rote memorization, pointless theories, all culminating in personal bankruptcy.

In lieu of personal responsibility pharmaceutical companies created chemicals to treat every symptom of a bad lifestyle. Doctors sold more narcotics than the Medellin Cartel. Pills were used to fix pills. The silver bullet was ever at hand with side effects ranging from uncontrollable diarrhea to sudden death.

Bear in mind, it all made perfect sense at the time.

Because nothing was more fake than the people who believed in all of it.

Don't Put Stock In The Day of Reckoning. Cash Only

All warnings are being ignored or otherwise ridiculed. The perfect set-up...

"Here are the 10 stocks you want to own on the day of reckoning..."

Warren Buffett's largest holdings:

IBM, Coke, American Express, Phillips 66, Procter & Gamble, Walmart, Goldman Sachs, Wells Fargo

Speaking of day of reckoning, last night China strengthened their currency the most in ten years, which just means that they are getting ready to weaken it again...They think we're all idiots, but they're only about 95% right. Even before I could write this, the currency was going down again...My hypothesis is that the Japanese Yen is putting massive pressure on China's capital outflows...

Below shows Yuan/Dollar (red) versus Dollar/Yen. Each time the Yen falls substantially, China's reserve outflow accelerates (not shown). HOWEVER, in March when the Yen fell the most, China's reserves fell very little. Which prompted this observer to ask whether or not the PBOC was now counting Yuan as Foreign Exchange aka. cooking the books...similar to how they cook their GDP numbers.

All of which portends for a major devaluation. Base case scenario:

Do you see the massive increase in Yuan (red). If not, you may need a new microscope...

Panic Time. From All Time Highs. What Else?

Today's volume was 2x the 10 day average...there's no way out now...HFT won't allow it.

JPY:

Macy's

Microsoft

Apple

Walmart

Growth/value

Small cap value

April's Fools: All Signs Point To Third Wave Down

Everything peaked and rolled over this week.

The Bank of Japan capitulated this week as the currency went into full RISK OFF mode. There is now a colossal divergence between carry trade risk and stocks...

Yen / Yuan

We can safely assume that shit's breaking in China right now...

WTIC WTF?

I'll take this as a blow-off top in oil...

Not withstanding blow-off tops in Facebook and Amazon, Nasdaq is leading the way down...

Price momentum has rolled over...

Breadth momentum has rolled over...

Money (out)flow:

Price / Volume:

Put option volume "Complacency"

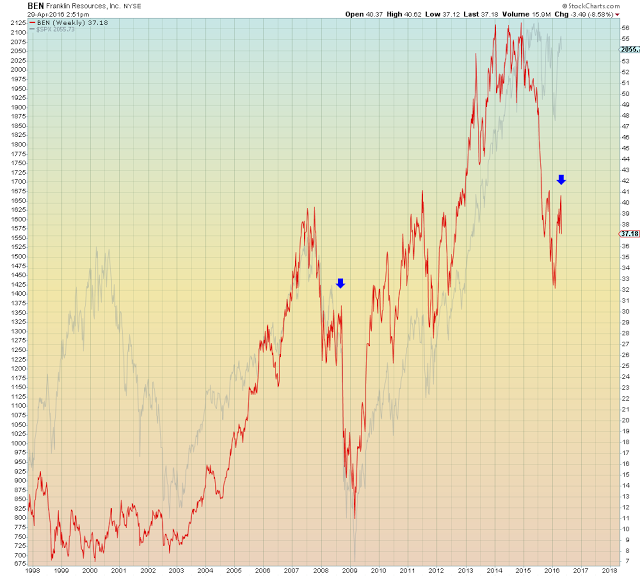

Wall Street (brokers/dealers) got whacked this week...

European Stoxx, back at the neckline...

Volatility was bid into the end of the week...

The Bank of Japan capitulated this week as the currency went into full RISK OFF mode. There is now a colossal divergence between carry trade risk and stocks...

Yen / Yuan

We can safely assume that shit's breaking in China right now...

WTIC WTF?

I'll take this as a blow-off top in oil...

Not withstanding blow-off tops in Facebook and Amazon, Nasdaq is leading the way down...

Price momentum has rolled over...

Breadth momentum has rolled over...

Money (out)flow:

Price / Volume:

Put option volume "Complacency"

Wall Street (brokers/dealers) got whacked this week...

European Stoxx, back at the neckline...

Volatility was bid into the end of the week...

Oil Is FULL Ponzi

It's a momentum feedback loop driven by the marginal fool...

If the cure for high inventories is low prices then why are inventories at an all time high despite oil prices at 2009 levels? Because of speculation and carry storage as opposed to final demand:

Inventories

And if the cure for low prices is increased demand, then why is the price so low while the long futures position is all time high? Again, purely due to speculation, which has only increased the amount of oil on the market.

Commitment of traders:

All of which means that oil has become 100% a momentum trade, that will end extremely spectacularly, once the last fool is found.

USO Volume indicates a low volume head fake

The long-term USO (ETF) chart indicates the colossal cost of carry losses incurred by speculators...

USO Spiked above the trend line and then gave it all back...

The Cost of Denialism: $Everything. No Refunds

Denialism is a contagious mental illness that afflicts the old and mentally weak. People who always want to be the last to know...

EM collapse, China collapse, oil collapse, global stocks, carry trades, commodities, profits, IPOs, all sectors.

0% recovery. Still they don't see it coming:

Because this isn't about one thing. This is about everything...

World Ex-U.S. versus S&P (ETF):

JPY: RISK OFF

U.S. Banks

Nasdaq 100 Stocks above 200 dma

Oil and oil inventories (U.S.):

New record high inventories this week...

"Game over, man"

Profits and interest rates

EM collapse, China collapse, oil collapse, global stocks, carry trades, commodities, profits, IPOs, all sectors.

0% recovery. Still they don't see it coming:

Because this isn't about one thing. This is about everything...

World Ex-U.S. versus S&P (ETF):

JPY: RISK OFF

U.S. Banks

Nasdaq 100 Stocks above 200 dma

Oil and oil inventories (U.S.):

New record high inventories this week...

"Game over, man"

Profits and interest rates

Subscribe to:

Posts (Atom)