The Idiocracy's obvious solution to a housing bubble caused by cheap money, was to make money cheaper. They were given six more years to wind the noose tighter, and they did so, without second thought. Now it's time for the bungee jump off the bridge...

No bid market. Visualized:

The Fed usually raises interest rates BEFORE the market peaks...

CNBC: Aug. 10, 2015

"Fed close to hiking rates, U.S. economy near normal"

Match meet dynamite aka. "normal"

1 Year interest rates (red) with deflation (black)

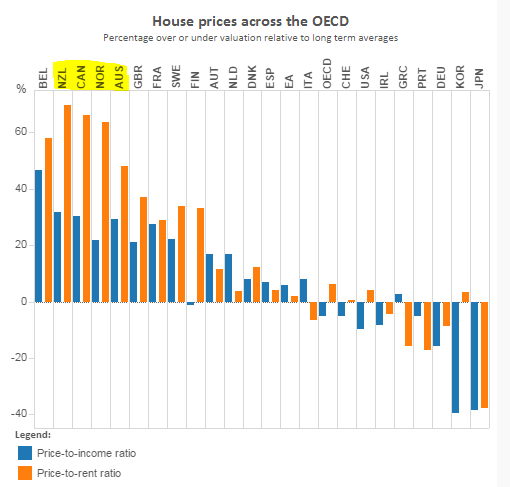

Fear of Missing Out ("FOMO")

The countries that were the least affected by 2008 decided they were missing out, so now they have the most overvalued housing markets - specifically, Norway, Canada, and Australia. Meanwhile commodities are collapsing, causing those respective Central Banks to lower interest rates, further inflating their housing bubbles. Those housing bubbles are going to implode violently amid what is known as a "no bid market".

The countries that were the least affected by 2008 decided they were missing out, so now they have the most overvalued housing markets - specifically, Norway, Canada, and Australia. Meanwhile commodities are collapsing, causing those respective Central Banks to lower interest rates, further inflating their housing bubbles. Those housing bubbles are going to implode violently amid what is known as a "no bid market".

ZH: Aug. 10, 2015

An Idiocracy is an infantile society that doesn't know anything, and doesn't want to know anything. It has no knowledge, no judgement, no wisdom, and no memory of the last time they got their asses kicked attempting the exact same asinine feat.

Only a generation that turned college into a Frat party, could be as dumb as this one.

Terminal.