While the plastic fantastic were busy blowing smoke up their own asses non-stop, all global markets peaked

Stocks are rolling over like it's Y2K

Emerging Market currencies and credit are getting shellacked like 1997

Commodities are in 2008 melt-down mode

All at the same time.

S&P 500

w/Price range of average stock

European stocks peaked in April

"No blind man saw that coming..."

NYSE Composite % of stocks above 200 day moving average:

'Conomy is entering a Third Wave Down, as indicated by the ratio of volatilities...

Zero margin of error visualized:

VXO/VIX ratio

CasinoConomy is in CYNK to the downside

(CYNK was a halted profitless IPO that re-opened at $0)

Casino is RISK OFF Now Too:

IPOs:

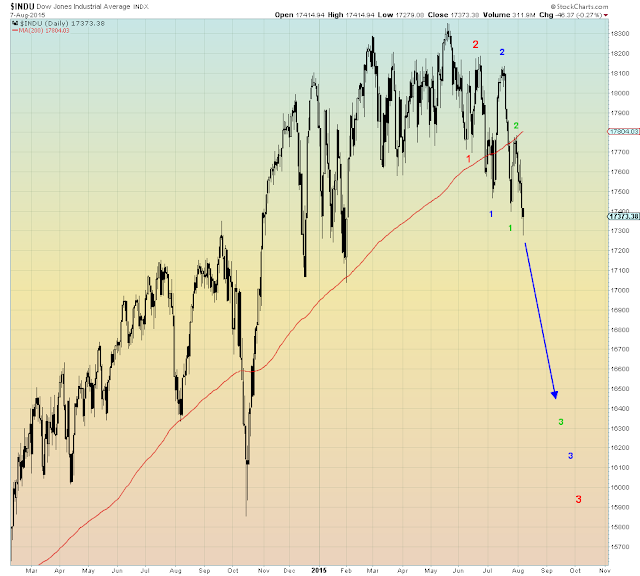

Dow Count: The Dow is now back at a level it first reached last September

10 months of gains are gone...

Shanghai Composite (red) with Dow

Biotech is getting hammered

Like everything else in the Idiocracy, this revenueless Biotech IPO had the shelf life of a rotten banana:

Junk bonds are getting mauled

Emerging Market Bonds and Currencies are in free-fall

Oil stocks are accelerating to the downside...

Exxon Mobil

Railroads are at new lows as well

Russell 2000 gives up 16 months of Gains

The leading U.S. index for six years, the Russell 2000 Small Cap Index, closed below its 200 day today and is negative on the year. It's now at a level first reached in March 2014:

The only thing that hasn't peaked is the non-stop bullshit.

The Liecovery visualized:

1 Year interest rates with U.S. deflation:

The Fed doesn't have one fucking brain between all of them