Belief in this charade is now existential to everyone who drank the Kool-Aid. Mainstream economists and the financial media have squandered their credibility on central bank alchemy. Worried they would lose subscribers if they didn't propagate popular delusion. In the end they will lose both credibility and subscribers...

Hugh Hendry On Imagined Realities

"On the one hand we have today's bears...They know that today's central bankers are spinning a falsehood of recovery; they steadfastly refuse to be suckered in by the euphoria of a monetary boom; and they are convinced that they will therefore be spared the consequences of the inevitable crash. Everyone else, currently drugged by the virtual simulation of prosperity and its acolyte QE, will be destroyed, leaving them alone, to re-invest when markets finally get cheap. They will once again be masters of the universe."

That was written back in late 2014 and unfortunately there are no more real bears left. Sure the smart money has moved to the sidelines, however they did so surreptitiously, in order to avoid detection. Doing one thing with their own money, while advising the exact opposite for everyone else's. Still publicly evincing full faith and credit in the MAGA Kingdom, knowing full well that the MAGA lie is now existential to their continued prosperity.

The mainstream media for their part steadfastly refuse to admit that they drank the Kool-Aid. In their view, perma-bears are irrationally pessimistic about the long-term prospects for simulated prosperity. They never once admit that they took a turn off the highway of sanity 10 years ago and never looked back. Hugh Hendry again:

"Investors have been living in a world in which markets have transcended reality since early 2009"

No no, the problem is these bears. They refuse to transcend reality. They steadfastly insist on adherence to facts and data, honesty, and sanity. They refuse to trade credibility for a rented vacation from reality. One having a brutally violent ending, on some unforeseen date. Unforeseen to those who drink the Kool-Aid.

Granted, I have said these things many times in the past decade, and in doing so missed out on the myriad asset bubbles that have soared and crashed in the interim. Too many to mention.

My primary objective was to avoid the biggest bubble of all - the dumb money index bubble. Knowing full well that its Big Bang collapse will end this entire Faustian charade post haste. Leaving ALL of the mainstream economists and media pundits wholly cleaved of any and all credibility until the end of time.

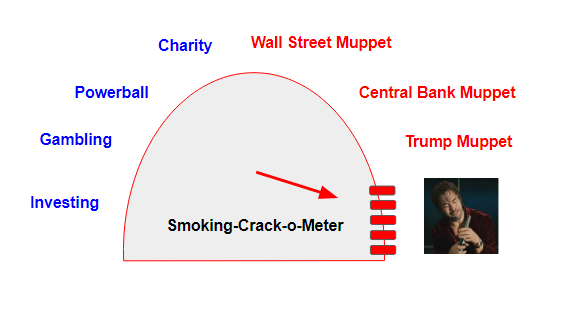

Here is a taste of their latest Kool-Aid:

Barron's this week:

"If there’s a fly in the ointment, it’s that so much of the market’s gains and aggregate value have been concentrated in megacap technology stocks, such as Apple, Microsoft, Amazon.com, and Google parent Alphabet (GOOGL)—a total of $4 trillion, or more than all of the Russell 2000 small-cap index"

Four stocks are now worth more than 2000.

If that's not asinine enough, those few stocks are going to continue driving the "market" ever-higher while the rest of the market implodes.

And on the subject of simulated prosperity and its acolyte "QE", we now see that the Fed has been double spiking the punch bowl with rate cuts AND balance sheet expansion:

Gamblers are thoroughly lubricated for what comes next

We got news this week that the trade war is over, or not...

"The truth is the gap is getting ever wider – putting both peace and growth at risk"

As they become the world’s main economic rivals and chief political adversaries, there is no doubt the US is seeking to contain China, while the Middle Kingdom is looking to challenge US leadership on anything and everything, on both a regional and global scale."

Belief in this charade is now existential for everyone who drank the central bank Kool-Aid for a decade straight. They don't have a "Plan B" waiting in the wings. Say for example living within their means.

Meanwhile, there is no more stimulus safety net. Central Banks have no "Plan B" either. The U.S. fiscal and monetary stimulus was squandered to expand the big, fat, ugly bubble.

Until it was winnowed down to a handful of massively overbought and overowned Tech stocks that continued to rise to meet the sun.

Exploding wholly unexpectedly at some point along the way.