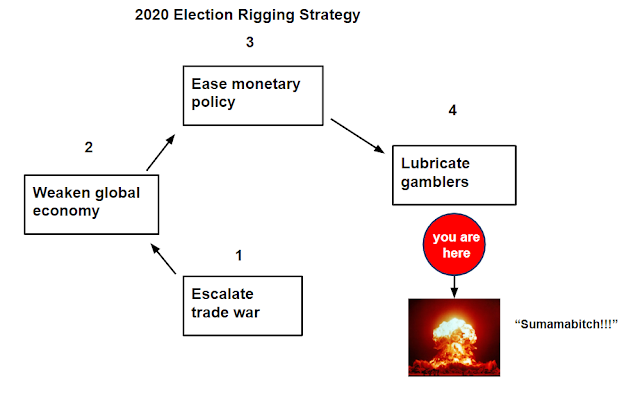

The trade war substantially accelerated global deflation, but then again, that was the "plan":

ZH: The Fed Is Underwriting Trump's Trade War

The best laid plans of known con men often go awry.

Trump's biggest mistake was firing Janet Yellen. She never drank the MAGA Kool-Aid. Whereas, like every other dunce, the current Fed was fooled by Trump's "Greatest 'Conomy in U.S. history" bullshit. Sexism is going to cost MAGATards everything. Everyone knows men blow shit up better than women.

Trump: Sept. 26th, 2016:

"We are in a big, fat, ugly bubble, and we better be awfully careful. Because we have a Fed that is doing political things by keeping interest rates at this level"

On the subject of mass delusion, it's indicative of America's moral collapse that no matter how much poverty flourished, economists at large and indeed most people, would never stop believing that greed solves poverty, even while the burial plot kept getting deeper and deeper...

“At every level we want more. Whether it’s the currency of beauty, the currency of fame, the currency of branding or the currency of sexuality, ‘Fake it till you make it’ can be just as valuable as having money."

"We’ve gone from a culture that prized hard work, frugality and discretion as the central tenets of the American Dream to a culture that prized celebrity, bling and narcissism"

Donny Land

Most never once stopped to question the self-destructive competition for "more". Even when the system of capitalism morphed from a system to generate prosperity, into a zero sum Darwinian game of unprecedented exploitation.

No matter how many warnings reality provided. No matter how many asset bubbles ended in greater insolvency. A society incapable of learning. Endlessly manipulated and conned until the American Dream turned into a hunger games Powerball lottery.

This entire mirage is compliments of "survivor bias" - always referencing the ever-dwindling pool of winners. While ignoring the ever greater pile of bodies stacking up in the background.

It's how all Third World countries operate. Poverty is invisible.

"No one saw it coming"

The "free money" spigot just slammed shut:

"The party is over. That’s the clear and unequivocal message coming from the market for initial public offerings, or IPOs, in the wake of the failed and overhyped IPO for Peloton, the exercise bicycle company, and two recently pulled IPOs—the one last week for the We Company, parent of WeWork, and the one yesterday for Endeavor Group Holdings, the parent of Hollywood superagent Ari Emanuel’s fever dreams"

"Tim Armour, the CEO of the Capital Group, which has nearly $2 trillion in assets under management, said at a Financial Times conference last week that the demise of WeWork’s IPO may be akin to the proverbial ringing of the bell at the top of the market."

"In its most recent report, Fasanara likened negative rates to “the magic and poisonous blood-red wishing apple, sending Snow White into deep sleep.”

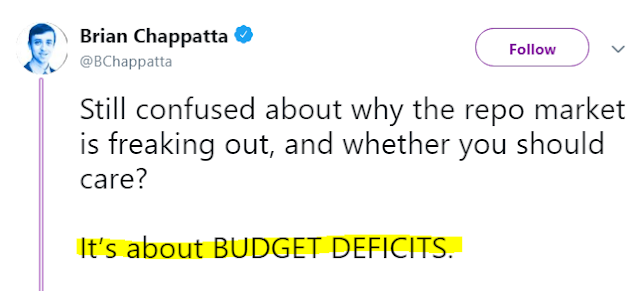

The liquidity crisis arrived in September in the overnight lending market, but it was assiduously ignored.

August 17th, 2019:

"Last month the U.S. Treasury laid out its plans to borrow $814 billion between July and December"

U.S. dollar liquidity is deteriorating and “is reaching a point where it may require drastic action if measures aren’t taken to address it soon,”

This is classic Econ 101: "Crowding Out" wherein public fiscal deficits suck up all available liquidity in debt markets.

U.S. debt, year-over-year change, $billions:

The record central bank priming has led to record corporate bond issuance at record low yields (high prices). Which has created a self-destructing mega bond bubble consisting of ebbing demand and inflated supply at ridiculously low interest rates which in no way price in default risk. As in the IPO market, record liquidity artificially suppressed insolvency while the financing window remained open.

"Liquidity risk is highly underestimated today,” the hedge fund wrote. “With it, the so-called ‘gap risk’, especially overnight gap risk"

"A volatility formula based only on the high-low range would fail to capture volatility from gap or limit moves. Wilder created Average True Range to capture this “missing” volatility"