"Investors are “all-in on equities,” Steven DeSanctis, a U.S. stocks strategist for Jefferies wrote in a Monday report."

Much of the cash that flowed into ETFs last week went to large-cap funds designed as core holdings"

Remember back in January 2018 ahead of the tax cut when hedge fund mega manager, Ray Dalio, said the market was on the verge of a melt-up and anyone in cash was going to look stupid? This is the right shoulder rate cut version of that delusion.

"More free money"

I wanted to use this post to show - outside of monetary market manipulation - what is going on in global risk. Starting from worst to "best", more or less:

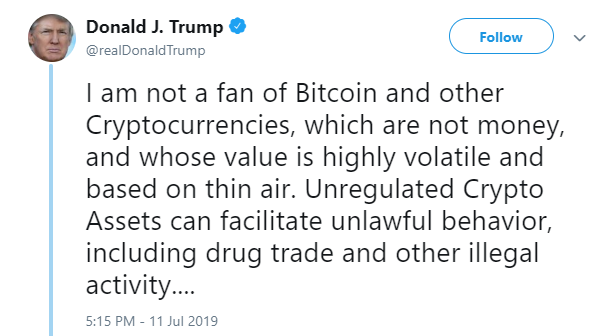

Begin with Bitcoin which had a rough weekend now that Trump has taken over monetary policy.

Highly volatile unlawful behavior based on thin air. No one likes competition.

In 2018 Bitcoin peaked a month ahead of the major stock indices. In this year it peaked three weeks ago, now carving out an identical fractal on the right shoulder:

Here we see that the Cheech & Chong trade is also now over, also on the right shoulder:

Semiconductors peaked almost three months ago. Now finishing up a three wave retracement:

China GDP was, as expected, the worst in 27 years, so China Tech caught a bid today, saving it from the trend line:

The dumbphone bubble is over, aside from short-covering. Apple's latest stock buyback announcement was poorly timed to coincide with trade war escalation.

Needless to say, the trade war is doing nothing for their imploding iPhone sales.

FANG stocks (Facebook Amazon, Netflix, Google) all peaked in 2018. None has made a new high in 2019, although Amazon is getting close.

I would be remiss if I did not mention that today is Amazon prime day. The day we celebrate the obliteration of the economy.

2019 has already surpassed 2018 in closures, and is on track to massively eclipse the 2017 record:

2019 has already surpassed 2018 in closures, and is on track to massively eclipse the 2017 record:

The Profitless IPO Bubble:

The overall index of recent IPOs (gray) hit a new high last week. Although the best performing IPO of the year, Beyond Meat, has rolled over.

Notice that pot stock Tilray had the same type of bounce Beyond Meat is having now:

The overall index of recent IPOs (gray) hit a new high last week. Although the best performing IPO of the year, Beyond Meat, has rolled over.

Notice that pot stock Tilray had the same type of bounce Beyond Meat is having now:

Which gets us to the remaining bubbles - stocks still making new all time highs.

These next three sub-sectors are all within the overall Tech mega bubble. I will list them and then show the overall Tech chart, since all of the charts look the same. Rising wedges.

1. Mobile Payments: PayPal, Visa, Mastercard, etc:

1. Mobile Payments: PayPal, Visa, Mastercard, etc:

2. Software: Microsoft, Oracle, SAP, Adobe etc

3. Cyber Security: Splunk, Palo Alto Networks, Checkpoint etc.

Normally I don't discuss gold, because it's more of a religion than an investment. And, because I may consider a rental in gold at some point in the future.

Nevertheless, here goes:

Here we see gold overlaid with European money printing. In 2016, gold peaked when German yields rose. Gold had the same look back then as it does now - three wave retracement. However, we also notice that gold bottomed last Fall when stocks peaked. And gold traded inverse to stocks through the fourth quarter. In summary gold bottoms first, and is highly sensitive to central bank panic attack.

"Low volatility" bond proxies (Staples, Utilities, REITS).

Minimum volatility, maximum explosion

Last but not least, when Trump's monetary market manipulation gambit blows up in everyone's face, his go-to re-election option will be the Keynesian bombing of foreigners.

In Banana Republican parlance: "GDP"