MAGA is the seven deadly sins, personified by Trump: Greed, Gluttony, Pride, Wrath, Envy, Sloth, Lust. Packaged in continuous deceit.

“We need to free ourselves from the clutches of consumerism and the snares of selfishness, from always wanting more, from never being satisfied, and from a heart closed to the needs of the poor.”

Sorry Pope, they had exactly ten years to learn that lesson and it was squandered digging a bigger hole. Those who wasted the past decade by still wanting more and never being satisfied, will find this unburial a tad more challenging. Meanwhile, we were also inconveniently reminded of the true cost of the "system" this week, as deaths of despair have doubled in the U.S. since 1999. Because after 2008, the system had to go into full Lord of the Flies mode by way of proving that it works.

"Dr. Miller attributed the increasing disparities in health care and inequalities in income as crucial factors in the feelings of despair, loneliness and a lack of belonging that contributed to suicides among many Americans."

Getting back to the circus...

MAGA is system risk, period. Nothing more, and nothing less. It's the lethal combination of leveraged hubris and risk that puts this circus at the brink of extinction, consisting of: Extreme leverage, extreme complacency, and higher interest rates.

This multi-month stock rally was predicated upon the end of the trade war, which we are told is imminent. And yet ironically, we learned this week that the U.S. trade deficit is record wide. Eclipsing the 2008 low. The net effect of Trump-o-Nomics has been to make the U.S. less competitive. The trade war did nothing to improve the balance of trade, while the tax cuts drove interest rates and the dollar higher aka. "Free money".

This is MAGA in a nutshell, farce and fraud on an epic scale, attended by manic speculation, and rampant denial.

For those who want a president who does the exact opposite of what he says he will do, Trump is the guy:

"We have a massive trade deficit, and I'm going to fix it"

Speaking of fraud, this week is the tenth anniversary of the post financial crisis bull market:

This just in:

And yet, despite the myriad warnings to date: consisting of global stocks peaking over one year ago, U.S. stocks tanking -20% in the fourth quarter, the housing market imploding, retail sales imploding, and finally Ponzi GDP imploding - even at this late juncture, the bimbos on CNBC are selling the dream.

And the sheeple are buying it with both hands:

Ten years later, and faith in Ponzi capitalism is now at existential risk. What I call "system risk". As we didn't learn in 2008, it's no one's job to manage systemic risk, so they don't. Instead what they do, is they keep selling to make the quarter. They keep stuffing Mr. Creosote with more leverage until he explodes. All the while ignoring the fact that he's getting fatter and fatter. And when it explodes, they say "no one saw it coming". That's the "system".

This set-up appears to be a lethal combination of VolPlosion 2018 and Smash Crash 2015. I've maintained all along that the machines can't handle the endgame of this circus, and I mean that now more than ever.

From an investment standpoint, I never give advice, but I will say this - the one thing I have learned this past decade, is spread your bets.

Why crash is extremely likely is because from a sector standpoint, there is no place left to hide. The great rotation from stocks back to bonds is already underway, as bond yields fall. Which means that the "safe haven" stocks are the final leg of the stool.

Here we see the equal weight S&P. Interestingly, the last time it was rolling over from this level was one year ago (February). That Friday pointed to by the arrow was the jobs report, as is tomorrow the jobs report. Monday was implosion. The casino this time is declining at a faster rate than last time:

Transports are now down ten days in a row:

Healthcare already rolling over:

Oil is a coiled spring:

Financials kissed the 200 dma goodbye, are now back in December mode:

Overnight risk comes via China and Emerging Markets:

The other overnight risk comes via Europe as the ECB just confirmed that the European economy is imploding.

The beloved IBD momentum stocks are right at the 200 day:

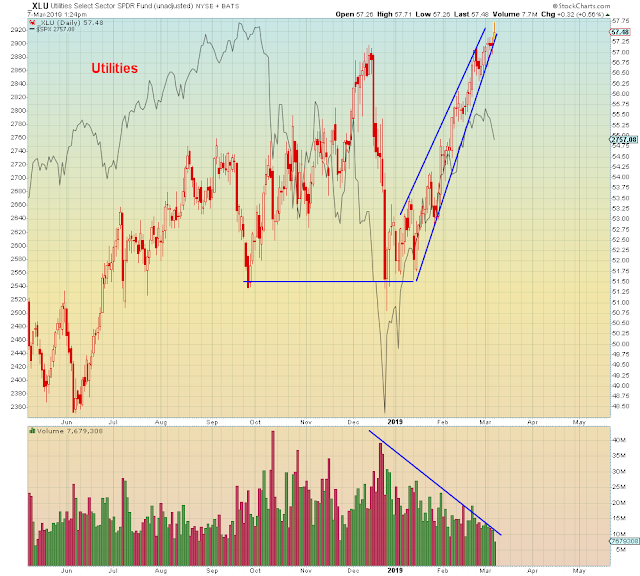

Utilities new high today, clinging to support:

The last safe haven:

Throughout this era of rampant denial, the cost of (not) hedging has been constantly rising in the background.

This shows the S&P volatility (VIX) relative to VIX volatility.

Basically indicating that the options market is ultra-sensitive to changes in volatility.

This just in:

And yet, despite the myriad warnings to date: consisting of global stocks peaking over one year ago, U.S. stocks tanking -20% in the fourth quarter, the housing market imploding, retail sales imploding, and finally Ponzi GDP imploding - even at this late juncture, the bimbos on CNBC are selling the dream.

And the sheeple are buying it with both hands:

Ten years later, and faith in Ponzi capitalism is now at existential risk. What I call "system risk". As we didn't learn in 2008, it's no one's job to manage systemic risk, so they don't. Instead what they do, is they keep selling to make the quarter. They keep stuffing Mr. Creosote with more leverage until he explodes. All the while ignoring the fact that he's getting fatter and fatter. And when it explodes, they say "no one saw it coming". That's the "system".

This set-up appears to be a lethal combination of VolPlosion 2018 and Smash Crash 2015. I've maintained all along that the machines can't handle the endgame of this circus, and I mean that now more than ever.

From an investment standpoint, I never give advice, but I will say this - the one thing I have learned this past decade, is spread your bets.

Why crash is extremely likely is because from a sector standpoint, there is no place left to hide. The great rotation from stocks back to bonds is already underway, as bond yields fall. Which means that the "safe haven" stocks are the final leg of the stool.

Here we see the equal weight S&P. Interestingly, the last time it was rolling over from this level was one year ago (February). That Friday pointed to by the arrow was the jobs report, as is tomorrow the jobs report. Monday was implosion. The casino this time is declining at a faster rate than last time:

Transports are now down ten days in a row:

Healthcare already rolling over:

Oil is a coiled spring:

Financials kissed the 200 dma goodbye, are now back in December mode:

Overnight risk comes via China and Emerging Markets:

The other overnight risk comes via Europe as the ECB just confirmed that the European economy is imploding.

The beloved IBD momentum stocks are right at the 200 day:

Utilities new high today, clinging to support:

The last safe haven:

Throughout this era of rampant denial, the cost of (not) hedging has been constantly rising in the background.

This shows the S&P volatility (VIX) relative to VIX volatility.

Basically indicating that the options market is ultra-sensitive to changes in volatility.

"I can free you from the clutches of always wanting more and never being satisfied"

It's called "MAGA"

It's called "MAGA"