This time around they bought two lies for the price of everything:

“It’s hard to impeach somebody who hasn’t done anything wrong and who’s created the greatest economy in the history of our country.” - Donny Madoff

A Ponzi scheme is a con job in which the rate of return is solely a function of the number of people who can be conned into it. Insiders cash out, while the public is buying in. The big, fat, ugly bubble that Central Banks, Wall Street, and Trump "conspired" to create since 2016 makes Bernie Madoff look like a rank amateur. Going into the last two weeks of the year, there is no liquidity...

The quality of this con job can be summarized thusly:

"American economic optimism took a sharp turn down in the fourth quarter from record high levels, with the CNBC All-America Economic Survey registering its biggest quarterly drop in its 12-year history."

Aside from plundering $1 trillion+ from the U.S. Treasury and shipping it to offshore bank accounts via stock buybacks, Trump's main accomplishment has been rolling back 2008 era banking regulations.

To facilitate the impending collapse:

BBG: ECB's Draghi Sees Economic Risks Worsening

"Our work is done here"

Therefore, in total absence of any fundamental basis for a rally, the Wall Street consensus Gartman trade du jour is that a "violent" short-covering rally will drive the casino higher into the end of the year; based solely upon the fact that there is absolutely no catalyst for such a rally. After all, it's not their money:

"This, then, is indeed a bear market and we have absolutely no choice but to trade it as such, selling strength first and buying weakness only later and at much lower prices...The public has not even yet considered selling their stocks that they’ve accumulated over the past several years, and they’ve certainly not acted to do so...This, sadly, is the same advice the public was given in early ’07 and into ’08"

"Our work is done here"

Therefore, in total absence of any fundamental basis for a rally, the Wall Street consensus Gartman trade du jour is that a "violent" short-covering rally will drive the casino higher into the end of the year; based solely upon the fact that there is absolutely no catalyst for such a rally. After all, it's not their money:

"This, then, is indeed a bear market and we have absolutely no choice but to trade it as such, selling strength first and buying weakness only later and at much lower prices...The public has not even yet considered selling their stocks that they’ve accumulated over the past several years, and they’ve certainly not acted to do so...This, sadly, is the same advice the public was given in early ’07 and into ’08"

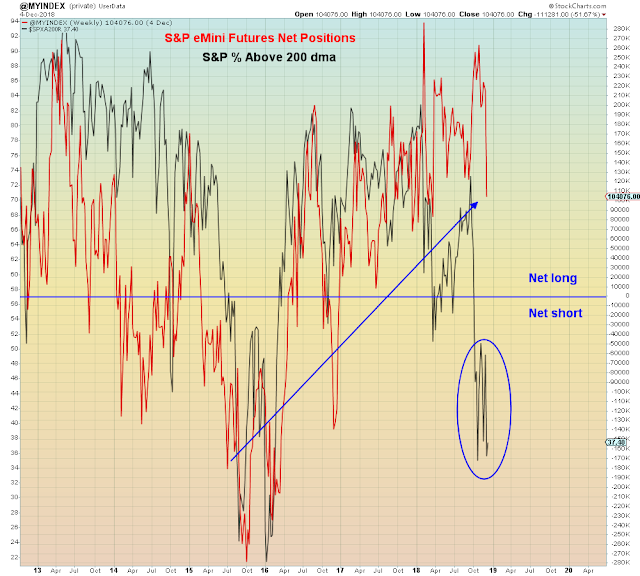

And yet, compare S&P futures positioning today to where it was when this rally started in early 2016. Still substantially net long. The last time the market was this weak, gamblers were net short:

Stocks are now competing with money market funds.

Where this gets interesting is that the recession stocks that are leading this rally are inherently weak as well. Although a handful have turned into zero growth momentum trades:

"The new Netflix!!!"

In summary, deflation is back with a vengeance and unlike early 2016, Central Banks are now in net tightening mode versus net easing mode:

Which means that it's all up to the machines now...

You know you're an optimist, when: