Remember way back in ~2005/06 when the Fed raised rates 17 times in a row and imploded the housing bubble? That's where we are right now - imploding all of the post-2008 bubbles.

The S&P just hit a new low for 2018. The Fed is now collapse dependent:

The S&P just hit a new low for 2018. The Fed is now collapse dependent:

Casino gamblers are trapped by the delusional narrative of the "greatest 'Conomy ever". The Fed is looking in the rear-view mirror in total agreement. Unfortunately, markets are forward looking and in the process of pricing in a slowing global economy, a tightening Fed, and margined out gamblers.

When Powell said this, the Dow shit a brick:

"Implosion will remain on auto-pilot, because it's a good decision"

"Implosion will remain on auto-pilot, because it's a good decision"

“We thought carefully about how to normalize policy and came to the view that we would effectively have the balance sheet run off on automatic pilot and use monetary policy, rate policy to adjust to incoming data. I think that has been a good decision”

Ironically, the real dislocations are taking place in the Treasury bond market where bond shorts are getting margined out of a job.

The Treasury market is now pricing in "Policy error":

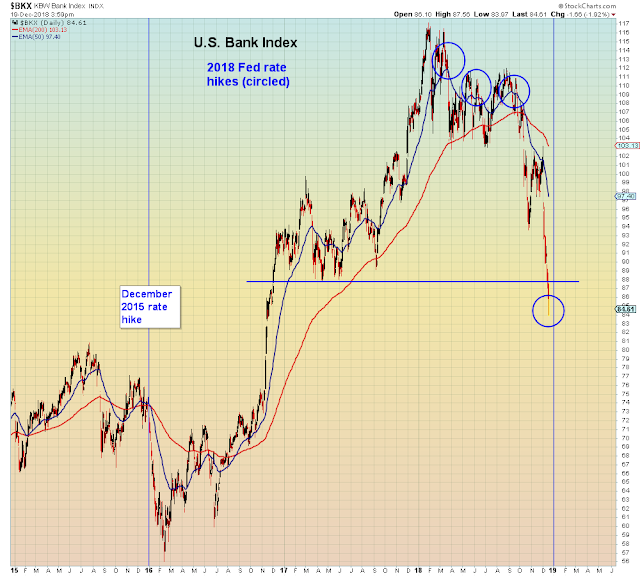

Deja vu of December 2015, Bank stocks not happy with further tightening

"Are you sure you know what you're doing?"

"Are you sure you know what you're doing?"

High yield "safe havens" not happy with further tightening

The world not happy with further tightening