Unfortunately, Skynet can't keep every global risk asset domino bid as they're being liquidated indiscriminately to meet margin calls. Which is why risk asset correlations are rising, along with volatility, heading for what I call "discontinuous price discovery"...

To say that this is going to be a clusterfuck, is an asinine understatement.

Which will confirm my count:

Herbert Hoover is getting his way. The last two elements of Trumptopian reflation are rolling over. Hard:

"I’d like to see the Fed with a lower interest rate. I think the rate is too high"

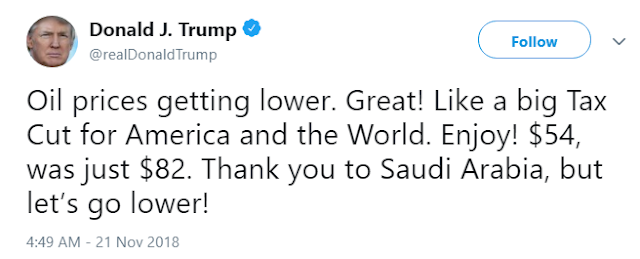

Right now we have low oil prices, or relatively. I’d like to see it go down even lower — lower."

Trump is using his support for Saudi Arabia vis-a-vis this journalist slaying (Khashoggi) as leverage to force Saudi to continue to oversupply the market.

The quid pro quo:

Trump is using his support for Saudi Arabia vis-a-vis this journalist slaying (Khashoggi) as leverage to force Saudi to continue to oversupply the market.

The quid pro quo:

This is what Donny doesn't understand - among many, many other things:

“The key point to remember here is that the lower oil prices are now a net drag on the U.S. economy, because the [capital-expenditure] cutbacks triggered in the shale oil business outweigh the gains to consumers’ spending from cheaper gas prices,”

Meanwhile long-term interest rates are also falling for all the wrong reasons:

Where this all gets interesting:

"You have tons of money managers with staggering losses in oil futures...If their investors want out or they just need to raise capital to meet the broker's margin calls, they need to sell something, and that often is stocks."

...too many investors are still heavily invested in oil futures."

What Cramer is describing is a 24x7 global margin call across every risk "asset class" from Bitcoins, to oil futures, Treasury short positions, EM bonds, Semiconductors, Mega cap tech stocks, Chinese internets, soybeans, lumber, you name it - to cross-cover margin calls in every other asset class. Driving asset correlations to 100% across the board.

The blood is in the water