Why have all major crashes happened in October - leaning on too much risk into the end of the year. A Wall Street tradition...

We are watching the casino stair-step lower towards a 1929-style crash while industry-captured dunces stand around circle jerking each continuously. With each lesser rally, they celebrate the usual triumph of bullshit over reality. Which takes the form of conning sheeple into believing something they shouldn't believe. In other words tightening the noose for the bungee jump off the cliff.

The narrative of the day - widely circulated on Wall Street but especially to frightened clients - is that programmatic selling caused the recent selloff. There was nothing "fundamental" that changed. Leaving aside the delusion, why random inexplicable computer selling can be counted as a bullish factor, is not the least bit explained. I suggest they revisit what is by far their most fatal assumption - that spontaneous massive computer selling is more profitable than human selling.

"Kolanovic has blamed the recent sell-off on so-called systematic strategies like risk parity funds and options hedging rather than fundamental forces"

Unfortunately, nothing could be further from the truth. There are a few things that have changed since the last selloff got bought with both hands, starting with "everything". But when all you have is a hammer, everything looks like a nail...

First off, complacency. there has been absolutely no panic selling in this decline so far. It's been all BTFD:

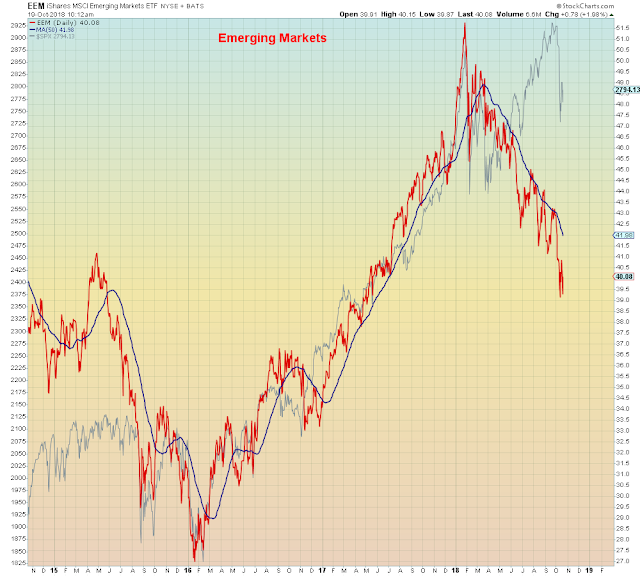

Global rotation: Global stocks peaked in February. Subsequently, money has been rotating out of the rest of the world to the U.S.

Global trade war: In February, the Smoot-Hawley trade war was a twinkle in Donny's eye, now the two largest economies are girding for a prolonged cage match.

Growth/momentum blowoff: Post-February, gamblers rotated to the riskiest stocks which enjoyed a blow-off top into late September and then fell off a cliff

Stock buybacks depleted: Back in February, stock buybacks based on tax cuts had not been announced. Subsequently $1 trillion have been announced and "priced in". Much of this 2018 rally was driven by short-covering in retail stocks under the auspice of "retail recovery", which was a hoax.

This was the best delusion $1 trillion of borrowed money could buy:

Breadth implosion: Breadth took a leg down in February, but then collapsed at the beginning of October

China/EM implosion. The subprime of this era. The China/EM selloff accelerated in late April when global growth expectations were ratched down by the IMF

Global liquidity reduction:

The Fed accelerated tightening on the long end each quarter this year. On the short end, the recent meeting minutes indicated a potential need to accelerate rate hikes. The ECB and BOJ are both winding down accommodation.

Yield spike:

The spike in yields accelerated in September

Peak earnings:

In late September, earnings warnings were the highest since early 2016

Tax cut sugar high wearing off/Economy peaking:

The Trumpflation rally (Banks, Energy, Transports) fell off a cliff

In summary, this is all very "bullish", if you like recession stocks "leading" the rally: