This week, escalating trade wars, rate hikes, balance sheet rolloff, and EM Implosion got bought with both hands.

The adverse outcomes of a market controlled by HFT momentum algos, are lower overall trading volumes, mass migration to passive investing, abject lack of concern for valuation, and unfounded complacency predicated upon derivatives-based market making. The tail has been wagging the dog, albeit amid periodic jarring smash crashes. It's all well and good until the global stop loss gets triggered, at which point Wall Street's well-cultivated "decoupling" fantasy morphs instantly back into a 100% end-of-cycle correlation pumpkin.

Throughout this Jedi Mind Trick, Wall Street continues to blow smoke up everyone's ass, because as we were informed at the top in 2007, you have to dance like a hairless monkey while the music's playing:

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance."

The cluster of recent Hindenburg Omens suggest that it's now getting "complicated" for the tail to keep wagging the dog:

2017 was the lowest volatility year in stock market history. When 2018 rolled around, gamblers went ALL IN. In late January, billionaire hedge fund manager Ray Dalio said at Davos: "If you're holding cash, you're going to be feeling pretty stupid". That was the top:

Subsequently, volatility exploded to the highest level in three years, as the casino crashed -10% in a straight line. The largest one day % move in the VIX since 1987. Now Ray Dalio is making the talk show rounds saying that the next global recession is a couple of years away (2020).

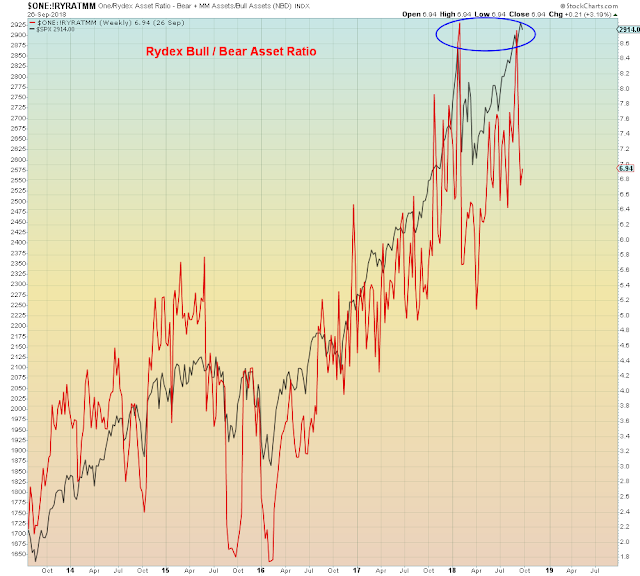

To celebrate, gamblers went ALL IN. Again.

Subsequently, volatility exploded to the highest level in three years, as the casino crashed -10% in a straight line. The largest one day % move in the VIX since 1987. Now Ray Dalio is making the talk show rounds saying that the next global recession is a couple of years away (2020).

To celebrate, gamblers went ALL IN. Again.

The cycle ends when gamblers pump and dump every asset class until their capital is exhausted. One sector after another falls by the wayside. Until finally only a handful of mega cap stocks are holding up the entire delusion.

Which is where we are now:

Despite yesterday's rate hike and warning from the Fed that stocks are overvalued, the Nasdaq crash ratio just reached a new extreme level:

This risk level can be seen via Nasdaq "New highs":

Small cap stocks are lagging badly:

Pot stocks are coming off the boil

Gamblers have been looking around hard for a new excuse to 'BTFD' and they surely found one. Even as the Fed promised more rate hikes, Emerging Markets are the new "safe haven":

"Just as the Federal Reserve steadily picks up the pace of rate increases, Wall Street’s quantitative strategists are telling clients to sell U.S. stocks and buy into emerging markets."

EM stocks can’t rally unless their nations’ currencies stabilize first"

More rate hikes is surely the key to stabilization:

"Given the 2013 taper tantrum and the 1997 Asian financial crisis, it’s a bit surprising that Wall Street is turning bullish on emerging markets now."

It's not surprising at all. The music is playing, and they have to dance. And pot stocks are no longer a safe haven from trade wars.

Any questions?

Not only is the Fed raising rates faster, their balance sheet unwind is set to accelerate again next week from $30b/month to $40b/month. Recall that the head of the Indian Central Bank warned a few months ago to "go slow" on balance sheet unwind. That's why it keeps going faster.

"The dollar bond market will face a crisis unless the U.S. Federal Reserve slows down the unwinding of its balance sheet, according to Reserve Bank of India Governor Urjit Patel."

"Is there any way we can make this implode faster?"

I think we all see where I'm going with this...

You heard it here first.