Trump's tax cut driven sugar high is wearing off, amid disappointing jobs growth, an expanding trade deficit, year-low construction spending, housing demand implosion, and missed services PMI. It was the best con job $1 trillion in borrowed money could buy...

"Production and new-orders indexes drop sharply"

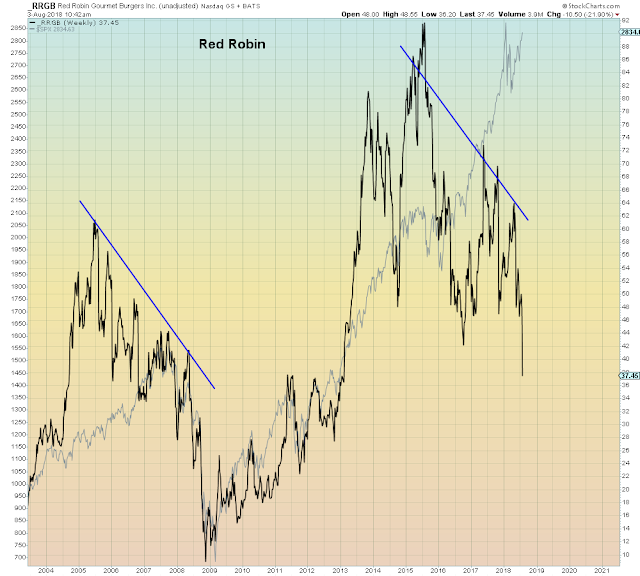

Many restaurant chains missed earnings estimates this cycle, among them: Cheesecake Factory, Shake Shack, Burger King (QSR), and Red Robin. Don't worry, it's only "the weather":

Sadly, compliments of non-stop bullshit, there is only one thing left to implode this clown show. Risk OFF is no longer an option...

This entire circus is now held aloft by history's largest mega cap Tech stock, now massively overbought and overextended. But really, what could go wrong? If my count is correct, everything...

This is what the average dunce is being told by their even dumber car-salesmen investment advisors:

"Wait and see how this all implodes, before you do anything that you might regret"

"...investors remain relatively relaxed about the tit-for-tat series of tariffs, threats and counterthreats flying between Washington and Beijing...the best strategy is to “wait and see how trade policy evolves"

"When you wake up to the S&P 500 limit down five days in a row, then it's time to reassess your asset allocation, if your broker is still online at the time. Or, just chalk it up to another con job"

This just in...

Taking out the front-running of tariffs that occurred over the past several months and the trade deficit would have been even wider. Clearly more tariffs are needed...

"[U.S.] Soybean exports surged again following a similar spike in May as Chinese buyers sought to stock up before retaliatory tariffs by their own government took effect."

"Production and new-orders indexes drop sharply"

Many restaurant chains missed earnings estimates this cycle, among them: Cheesecake Factory, Shake Shack, Burger King (QSR), and Red Robin. Don't worry, it's only "the weather":

Sadly, compliments of non-stop bullshit, there is only one thing left to implode this clown show. Risk OFF is no longer an option...

This entire circus is now held aloft by history's largest mega cap Tech stock, now massively overbought and overextended. But really, what could go wrong? If my count is correct, everything...

This is what the average dunce is being told by their even dumber car-salesmen investment advisors:

"Wait and see how this all implodes, before you do anything that you might regret"

"...investors remain relatively relaxed about the tit-for-tat series of tariffs, threats and counterthreats flying between Washington and Beijing...the best strategy is to “wait and see how trade policy evolves"

"When you wake up to the S&P 500 limit down five days in a row, then it's time to reassess your asset allocation, if your broker is still online at the time. Or, just chalk it up to another con job"

This just in...

Taking out the front-running of tariffs that occurred over the past several months and the trade deficit would have been even wider. Clearly more tariffs are needed...

"[U.S.] Soybean exports surged again following a similar spike in May as Chinese buyers sought to stock up before retaliatory tariffs by their own government took effect."

Six months ago during February VolPlosion, everything went risk off at the same time however Tech caught a 'BTFD' rotational bid and ran to new all time highs. Picture the scenario where that doesn't happen. Because say for example there are only two Tech stocks still making new highs - Apple and one other one, probably Go Daddy...

Computers are the "binary" in this binary risk event. Because unlike people, machines don't panic, they just go offline. Because, as my daughter likes to say: "TMI - Too much information"...

I think we all see where I'm going with this:

The bottom line in all of this is that today's investment "gurus" are not all that bright. Even the self-nominated brightest ones, who are all crowded into the exact same trades:

Two weeks ago:

"Nearly 70 percent of those surveyed said Amazon will reach the trillion-dollar value milestone first"

"investors may be betting that Amazon’s stunning stock momentum this year will continue"

I think we all see where I'm going with this...

The S&P isn't tracking Apple, it's tracking Amazon...

"Time to bye"