This week summarized:

Picture a scenario wherein a 1997 currency crisis was occurring at a Y2K Tech blow-off top, at the end of the cycle, during a trade war, a commodity rout, a rallying dollar, and a tightening Fed.

Deja vu of Y2K, Tech is rolling over

Yet despite the highest risk in world history, instead of seeking protection, they are actively shorting the safe havens in record size:

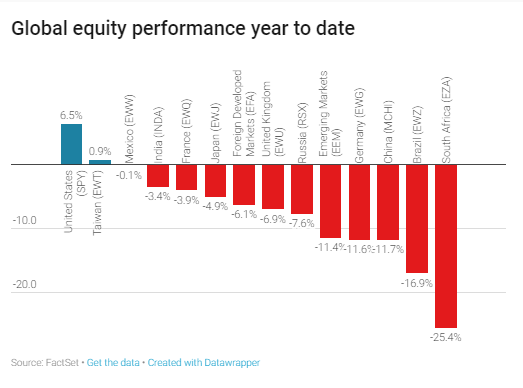

Not even taking out insurance on Emerging Markets now down 20%:

Why?

Because the U.S. is decoupled from the rest of the world.

"According to a new report, China now appears willing to undertake a major currency devaluation - similar to the policy changes that roiled global markets in late 2015 and early 2016. The move by the Chinese government would help to offset the effect of the Trump administration's enacted or threatened tariffs on some $250 billion of imports from the country"