Sadly however, the power of delusion is once again turning back into a pumpkin:

"There are times when an investor has no choice but to behave as though he believes in things that don't necessarily exist...that means being willing to be long risk assets in the full knowledge that those assets may have no qualitative support; and second, that this is all going to end painfully. The good news is that mankind clearly has the ability to suspend rational judgment long and often"

"The good news is that Trump got rid of the Fiduciary Rule, so we can tell idiots anything they want to hear, long and often"

This should be an interesting day for fake reflation. The Department of Energy just confirmed last night's inventory numbers from API:

Crude is now below the one year trendline:

Oil gamblers never got the memo that the OPEC supply cut is over:

The Fed decision is at 2pm

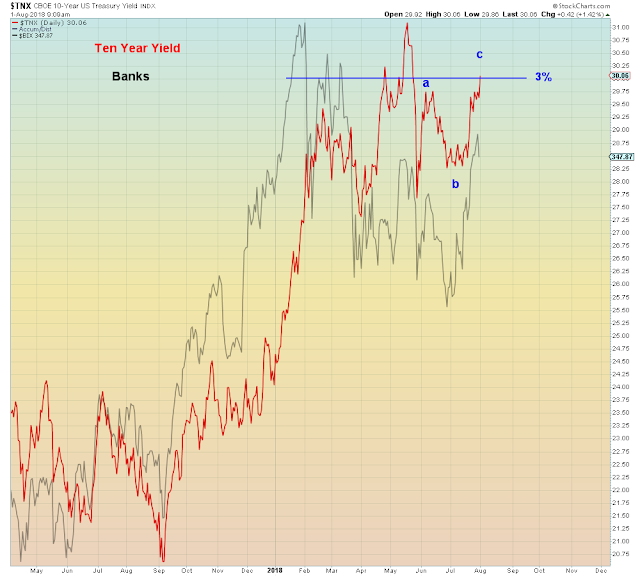

The ten year yield is backtesting 3% in a three wave retracement.

Because record bond shorts never got the memo that tax cuts for the ultra-wealthy and rate hikes for everyone else, is not "reflationary":

Bank stocks are wrapping up their one month long bounce.

Because bank gamblers never got the memo that fake reflation is fake:

Industrials are bouncing in a three wave flat, because they never got the memo that the trade war is not over...

China Tech getting shellacked again today:

EM credit is bouncing from the 2016 Maginot Line, because they never got the memo that the rate hikes are going to continue until everything implodes:

Consumer Staples are backtesting the 200 dma, because gamblers never got the memo that there is nowhere left to hide...

Momentum gamblers are dangling in no man's land, because they didn't get the memo that there is no one left to con:

Last, but not least, the race for $1 trillion on 5x average volume.

Mind the reversal of fortune:

In summary:

This is what happens when denial gets out of control...