On the surface of the Dow Jones Illusional Average everything looks "fantastic". Beneath the surface, is a MASSIVE end-of-cycle short-covering rally, rotation into recession stocks, RISK OFF Tech, and nascent bond market rally. Good times...

MW: The Dow Just Registered Its Longest Correction In 60 Years

"This is NOT a bear market. It's just the longest correction ever"

Here we see the super-cycle short-covering rally, led by the most beaten down retailers:

A closer view of the index by itself, not as a ratio:

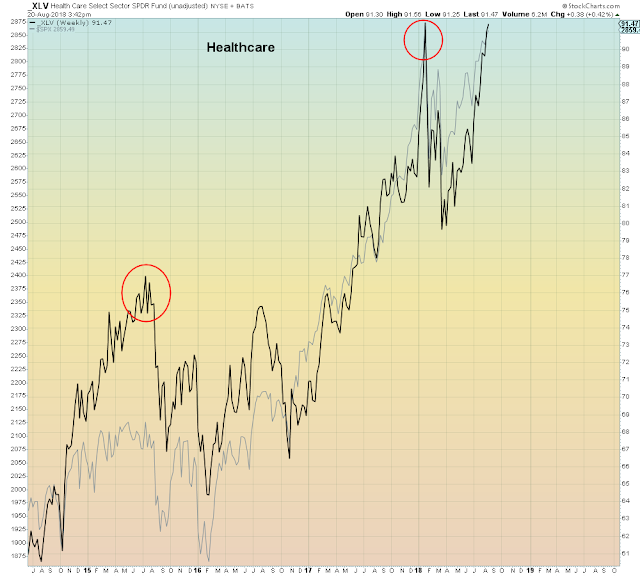

Healthcare is making a good (corrective) run, right?

Here we see the recession trade as a ratio of S&P over Utilities:

Record bets on fake reflation are getting crushed:

This is the reason why the Nasdaq fired off five Hindenburg Omens in the past two weeks:

New lows are expanding on every down day, despite the index still near all time highs

Stair-stepping lower to panic time:

Stair-stepping lower to panic time:

Germany is the next shoe to drop