Tax cuts versus trade wars. The 1930s Smoot-Hawley trade is on in size. The stakes have never been higher...

Any questions?

As we enter Q2 earnings reporting season, the $200 trillion dollar bet that's on the table right now is that Trump's tax cuts will override the effects of the trade war. It's the patented "I want my cake and eat it too" strategy in a nutshell. Unfortunately for Generation Madoff, it won't work out that way. Instead it will be a very long overdue lesson in inter-generational exploitation. Made even better by the fact that they don't see it coming...

As I showed in my prior post, this fantasy sentiment pervades CNBS once again, now entering the new earnings season, despite the fact that the Q1 earnings buyback blackout was a rocky ride. And yet this same sentiment was summarized by another idiot on Zerohedge today:

"...As such, I am not bearish on SPX; the front-loaded corporate tax cuts will provide near-term support for earnings while the debt balloon is deferred to the Millennials (who to their chagrin, forgot vote)"

To the victor go the spoils. "We" the older generation have been offered another George W. Bush style opportunity to plunder our children mercilessly because fortunately we raised a generation that "forgot to vote". Need I say more about the state of morality at this juncture. It's null and void.

Hard to believe for someone coming from the Financial Services industry of bailed out con men, but there are factors at work to undermine this 1929-era all or nothing gambit.

First off, the Fed pre-programmed their balance sheet rolloff to self-destruct global markets. That way they could take the summer off, without having to manually intervene in the process.

The second thing to understand, is that the EM implosion is "someone else's problem". It belongs to those people with funny accents who have a different word for everything. The term "contagion" won't be trotted out again, until it's a day late and many trillion dollars short.

This is another part of the wishful delusion - the inverted yield curve is bad, but it won't be a problem until it fully inverts, which is December.

"The Yield Curve, as described as the difference between the T2yr vs T10yr rates, will not invert until near the December FOMC meeting"

Unfortunately for DunceTopia, S&P banks don't see it that way:

The fantasy gets even better, because recession is then another 18 months later. This by the way is what every single Groupthink dunce on Wall Street is saying right now:

"This is when to start the clock for the typical 18-month lead-time to a recession (sometime in mid-2020)."

Unfortunately, recession stocks don't see it that way:

Lastly, with bond shorts at a new all time record, needless to say, inverting the yield curve need not wait until December. I'm not sure where he gets that idea from. All it will take is an overnight global RISK OFF trade to send bond shorts stampeding for the narrow exit.

This below is the Hotel Californication. The last time the yield curve was this flat, gamblers were massively long bonds. This time, they are record short. These are not intelligent people.

On another note, Trump is in Europe this week for the NATO summit. FWIW, I am in the camp that NATO is a dangerous Cold War anachronism. Nevertheless, the triple constraint that Trump doesn't seem to understand about Globalization, is this one, below.

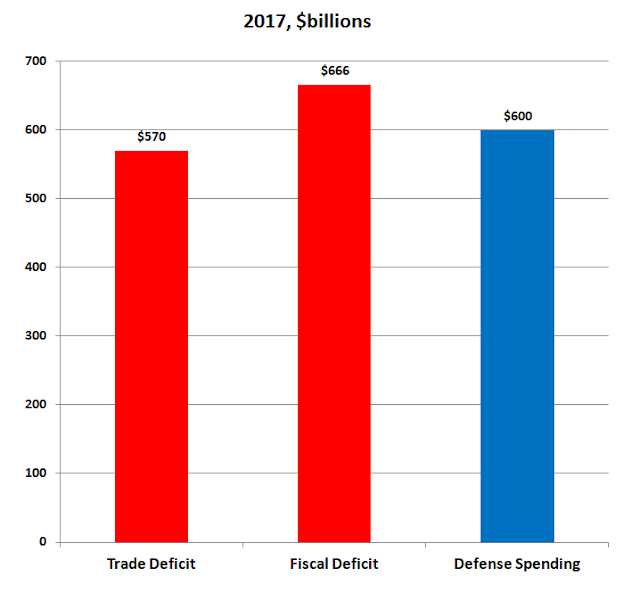

Imbalanced trade funds the U.S. fiscal deficit which under Trump's 2018 budget (not shown) will equal U.S. Defense spending. In other words, it's ALL borrowed money and it's ALL borrowed from overseas.