"Did you exchange a walk on part in the war for a lead role in a cage?"

- Pink Floyd, Wish You Were Here

I could blog all day at this point, the amount of dysfunctionality on display today is unprecedented. One thing all of today's thought dealers share in common is the desperate need to pretend that the abnormal is normal. They are experts at rationalizing away events that in any other era would be considered inexplicably asinine...

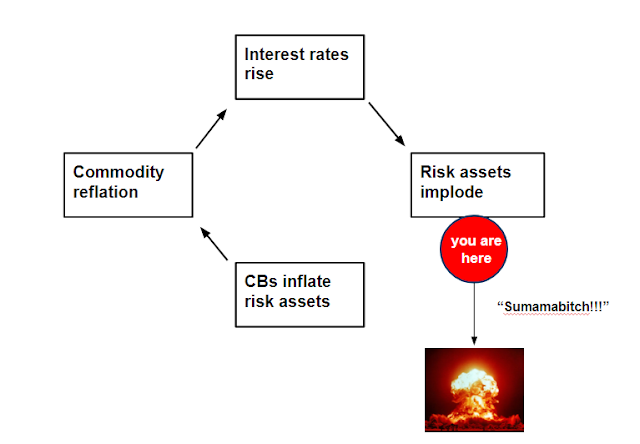

What I'm trying to say is that contrary to the above circle flow, Central Banks can't put the toothpaste back in the tube at this point:

"We fucked up. Let's circle back for another try"

Peeling back the layers of the collapsing onion there is one fatal weakness that confronts this rapacious Ponzi society - which is its abject lack of inherent morality. Especially with respect to their fellow (wo)man. Rampant cynics claim that "it's always been this way" and that a more congenial society is more Sunday school fantasy, than real-world reality. Unfortunately, that self-serving viewpoint is itself abiding fantasy. Because in my lifetime we've never witnessed anything near this level of desperate conniving.

And more to the point, those who assume that someone else will always be in the firing line, are the ones who are next in the firing line. It's only their singular focus on the prey ahead that keeps them from realizing they are being hunted from behind.

The problem in a nutshell is that tax cuts disproportionately benefit the ultra-wealthy, whereas higher energy costs and higher interest rates disproportionately affect everyone else. So the assumption that a tax cut can offset the resulting rise in inflation and interest rates is sheer fantasy.

This can be seen via collapsing auto sales and rising delinquencies, it can also be seen via the ratio of wages to CPI:

Where this gets interesting of course, is watching Wall Street lie constantly to their clients. Because as we know, their mantra is to dance like a hairless monkey until the music stops.

So how then do they explain to their ever-more anxious clients that there are no more chairs left on the dance floor?

Without parsing loads of bullshit, I found this Citigroup fantasy depiction interesting:

"Matt King who far more credibly warns Citi clients that the real yield cycle is now transitioning from Stage 3 to Stage 4 when equities get painfully whacked..."

I call this the 2016-redux fantasy. Wherein stocks take a bit of a knock and then Central Banks come together on a new "Shanghai Accord". To bail out gamblers.

This is what every single investment advisor is telling their clients right now aka. BTFD.

In any other era, this would be considered FULL RETARD:

This is what every single investment advisor is telling their clients right now aka. BTFD.

In any other era, this would be considered FULL RETARD:

No honest assessment of the above Ponzi risk cycle would be complete without consideration for why 2018 is not 2016. Specifically around the fact that 2016 was not the end of the cycle.

Step 4. Flight to quality

As we see, the flight to quality that occurred in 2016 is no longer an option.

Why? Because the tax cut drove higher interest rates, which killed the recession trade:

Why? Because the tax cut drove higher interest rates, which killed the recession trade:

What I'm trying to say is that contrary to the above circle flow, Central Banks can't put the toothpaste back in the tube at this point:

Which means one thing, gamblers will now rotate from Netflix back to bonds:

And the end-of-cycle version of the Citigroup circle jerk doesn't have a happy ending:

"We fucked up. Let's circle back for another try"