MBA for Complete Idiots:

Warren Buffett: Free Trade Turned American Workers Into Roadkill

This zero sum mentality is now driving gamblers to chase tax repatriation while Emerging Markets get monkey hammered by the stronger dollar and reduced liquidity, due to tax repatriation.

The last time we saw this much back and forth between the 50 dma and the 200 dma, is the last time Emerging Market currency devaluation imploded the casino...

CNBC Fast Money, April 4th, 2018

"This kind of set-up resolves sharply...and I believe to the downside"

"Safe haven"

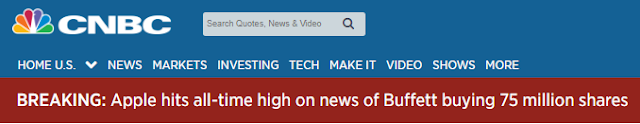

The Oracle of Ponzi World is holding court this weekend for his annual Ponzi circle jerk. Hence, the repatriation of Apple's multi-hundred billion cash hoard was the theme of the week...

"Forget that iPhone thing, only the cash matters"

Unfortunately, it's Buffett who is totally missing the point:

ZH: The Real Story Is the Ongoing Emerging Markets Rout

"the big story remains the recent surge in the dollar and the accelerating rout in Emerging Markets, where a bevy of currencies, including the TRY, ZAR, INR, IDR and especially the Argentina Peso most recently, have all gotten crushed, in many cases sliding to all time lows, prompting some to ask if another 1997-style EM crisis is on the horizon"

These are the things that don't like tax repatriation:

Just one more thing to ignore when Apple is rallying

"Was it just a mirage? The stronger, more synchronized growth in the world economy that powered markets in 2017 has faltered at the start of 2018. As that has become ever clearer in recent weeks, the U.S. dollar has rebounded suddenly and surprisingly. The uncomfortable reality is that economic, financial and monetary-policy cycles are in very different places around the world."

What Treasuries are saying about the U.S. economy

In short, Buffett should not be obsessing about Apple's stock buyback program

April 19th, 2018

1x leveraged ETF