"You've got to dance while the music is playing" - Citigroup CEO, 2007

As we've seen so many times before, risk asset correlations are low during rallies and then converge to "100%" during declines.

Kind of like this...

ZH: Risk Asset Correlations Highest Since 1987

As I was saying in the previous post, the speculative cycle ends when valuations become extreme at the end of the cycle. A lethal combination, featuring a fall in "P" and "E" at the same time.

This is quite a con job. You'd have to be in a stoned coma to believe it.

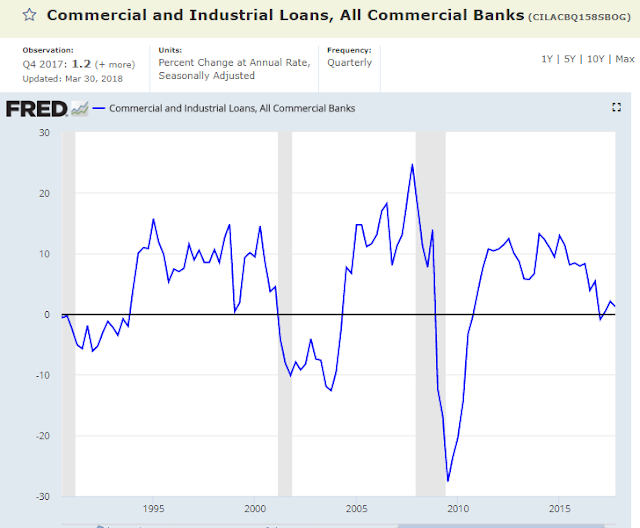

Cycle peak earnings for banks amid record post-WWII fiscal stimulus. aka. total fucking waste of money

"On Friday, JPMorgan said its quarterly profit jumped by more than one-third to an all-time high, helped along by hundreds of billions in tax savings

What’s less clear is whether the hoped-for effects of the tax cuts are reaching the business community the banks serve, and rippling into the broader economy"

"Less clear"

The two largest banks in the U.S.:

ZH: Wells Fargo Reports Worst Mortgage Number Since 2009

ZH: JP Morgan Sweeps Credit Card Delinquencies Under The Rug

Of course, they bought it hook line and sinker...

CNBC: Stocks Will Try To Ignore Reality On Friday the 13th

"Jeffrey Saut, chief investment strategist at Raymond James, said he believes the market has successfully retested its bottom at 2,532 on the S&P 500 and he has been a buyer.

"I think the bottoming process was textbook. You got a failed throwback rally, you came back down and made an undercut low"

"I bought for the tax cut, but when that didn't pan out, I stayed for the trade war and WWIII"

Bonus charts:

The Nasdaq has now back-tested the two year trend-line.

Large cap internet (Facebook, Amazon, Google etc.) carved out a right shoulder:

China Tech is heading back down to the stop loss line...

As are the momentum names

One thing we know with 100% certainty, they don't see it coming:

January 31st, at the all time high:

Jeff Saut: The Nine Year Bull Market Has Many Years To Go

CBOE Skew index:

"The crash of October 1987 sensitized investors to the potential for stock market crashes and forever changed their view of S&P 500® returns. Investors now realize that S&P 500 tail risk - the risk of outlier returns two or more standard deviations below the mean - is significantly greater than under a lognormal distribution"

An Idiocracy has no forever, there's not even a two months ago...

January 24th, 2018

"The S&P 500 has already rallied 6.2 percent in January, posting only three down days and clinching its strongest showing since 1987"