But first, the gamblers celebrating the pseudo-economy consisting of no wages:

There can be no wage growth, because Supply Side economics is the preference for return on capital over return on labour. Which means that at any sign of wage inflation, interest rates rise stamping out "reflation". It's a Faustian Bargain terminating at Third World status.

But don't take my word for it:

"As far as investors are concerned, the key point is that most Fed policymakers still seem pretty confident that inflation pressures won't follow too far behind wage pressures, as businesses pass along a portion of their higher wage bills..That's why an interest-rate scare is looking possible, even if a legitimate inflation scare doesn't materialize.

This week, Kroger, Dollar Tree, and Ross Stores all said they're raising wages for employees, and their stocks sold off amid worries about profit margins."

Got that?

"We must raise interest rates to protect the jobless consumer from the damaging effects of higher wages"

Clearly, the U.S. has gone full retard, a function of having too many global multinationals domiciled in the U.S., conflating their own interests with that of the country.

Yesterday, the S&P closed at the exact same level as January 8th - two months to nowhere. Hemmed in between the 50 day and the rising trendline. Three lower highs each tracing out the same retracement fractal:

The Nasdaq 100 is the strongest index and likely to make a new high post the "more than expected McJobs, weaker than expected wages" report.

As a reminder, the last three times the VIX spiked to 50 it was because large caps had rolled over. This time, large caps have not rolled over.

Yet.

It's all Amazon now

Large banks are rolling over at the 50 day, same as last time(s):

Homebuilders have left the building

Europe third lower high:

Bitcoin is getting pole axed again. I noticed that Bitcoin always rolls over slightly ahead of the S&P:

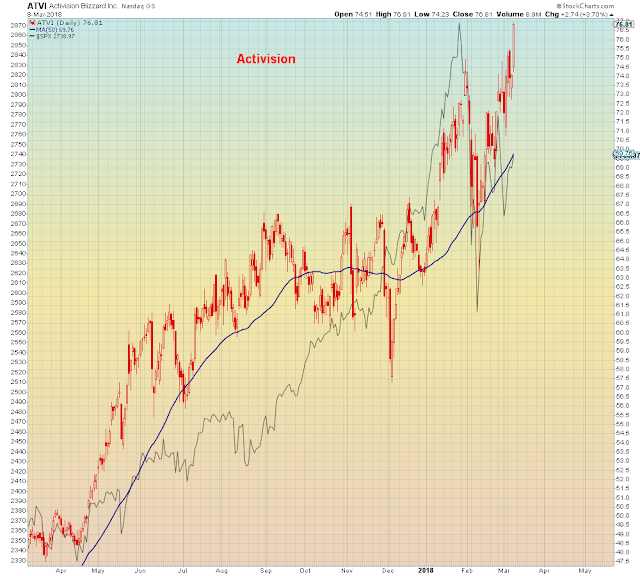

Video games are a great end of cycle growth play:

At least they were during the past two cycles:

The big story this week were the tariffs on steel and aluminum made official yesterday. Meanwhile, with all of Trump's growing Russian/porn star/money laundering/legal entanglements, no one with an IQ greater than 5 will be willing to join Trump's gong show going forward - It's an invitation to have the NSA data mining your cell phone calls for the past 10 years. And otherwise be ostracized from the entire planet ex-Trumpfuckistan. I heard through people who know Gary Cohn's wife that she threatened divorce if he didn't quit. Her social life is probably permanently ruined anyways. Her husband will always be known as the guy who plundered Obamacare and Social Security to get a tax cut for Goldman Sachs and $800 billion in stock buybacks to pay for insider selling dilution.

Even Larry Kudlow turned down the job. And if you can't get that guy, where to go next Joe Kernen? Bernie Madoff?

The chart of the week:

For all of that hyperbolic bullshit, steel stocks were down on the week. the rest of the world hangs by a thread:

As a reminder, the last three times the VIX spiked to 50 it was because large caps had rolled over. This time, large caps have not rolled over.

Yet.

It's all Amazon now

Large banks are rolling over at the 50 day, same as last time(s):

Homebuilders have left the building

Europe third lower high:

Bitcoin is getting pole axed again. I noticed that Bitcoin always rolls over slightly ahead of the S&P:

Video games are a great end of cycle growth play:

At least they were during the past two cycles:

The big story this week were the tariffs on steel and aluminum made official yesterday. Meanwhile, with all of Trump's growing Russian/porn star/money laundering/legal entanglements, no one with an IQ greater than 5 will be willing to join Trump's gong show going forward - It's an invitation to have the NSA data mining your cell phone calls for the past 10 years. And otherwise be ostracized from the entire planet ex-Trumpfuckistan. I heard through people who know Gary Cohn's wife that she threatened divorce if he didn't quit. Her social life is probably permanently ruined anyways. Her husband will always be known as the guy who plundered Obamacare and Social Security to get a tax cut for Goldman Sachs and $800 billion in stock buybacks to pay for insider selling dilution.

Even Larry Kudlow turned down the job. And if you can't get that guy, where to go next Joe Kernen? Bernie Madoff?

The chart of the week:

For all of that hyperbolic bullshit, steel stocks were down on the week. the rest of the world hangs by a thread: