Globalization is the biggest con job in human history without any comparison. Of course, that was readily apparent in 2008. Fast forward ten years, tens of trillions of more debt, and tens of trillions in printed money. And here we go again...

Europe has broken the two year trend-line and the 35 week moving average (200 day):

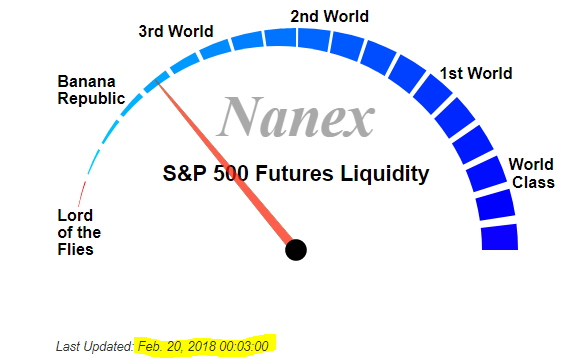

Nanex posted a tweet on Feb. 17th indicating that since 2005, Europe has accounted for 50% of the S&P futures gains. 2am-3am is the European open in New York:

Of course that sword cuts both ways - Sunday night (Monday, Europe), the S&P futures traded off 15 points beginning at 2am.

It appears that Europe is already heading into "retest" mode. However, the margin of error is a tad slim:

Meanwhile, in buy-every-dip-land, we see what I was talking about previously - large caps were not a part of the recent welcome "correction":

One of these is not like the others:

China is taking holidays for Lunar New Year, but will be back on Thursday to join the retest:

Canada just boomeranged back below the 200 day, but that has only imploded the U.S. every other time. So who knows what will happen this time...

Japan is ready for the re-test. Of course the last two breaks of the 200 day (red line) likewise imploded global risk:

Apple. Good to go...

High Beta. Ready

"Minimum Volatility". What else?

"Liquidity has recovered to normal levels"