It's abundantly clear that absolutely NOTHING was learned last week. Unfortunately, you can't warn zombies. This is going to monkey hammer these fuckers back to the Stone Age...

Last week, the one-sided short volatility trade imploded overnight following a hotter than expected wage report on Friday Feb. 2nd. On that Friday, the wage report caused some early consternation followed by a ramp higher. Followed by implosion last week. Deja vu, this morning following a hotter than expected CPI, the futures gapped down 50 points and then the dip got bought with both hands:

ZH: Treasury Yields Have Reached The Death Zone

Deja vu:

The locus of maximum pain from these yield spikes is focused obviously on bonds, but also dividend yielding stocks. Tech and Financials get a free ride higher. In the event, big cap Tech and the reflation trade have become ever more crowded during the past two weeks - as evidenced by record high crude futures long positions, and record short Treasury positioning. Meaning that the vaunted 'correction' never reached the entire risk market.

Here is where it gets interesting. The last time Treasury shorts hit a record high was one year ago, last February, 2017. Which is when yields peaked, and bank stocks...

Meanwhile, large banks are still above the 50 day moving average:

For now...

As are large internet stocks aka. Amazon et al.:

Totally ignored by the casino was the fact that retail sales are now tanking:

U.S. retail sales unexpectedly fell in January, recording their biggest drop in nearly a year, as households cut back on purchases of motor vehicles and building materials.

The 'consumer' is tapped out, and so the question is beyond Q1 what does GDP look like?

You can't warn an Idiocracy

ZH: Notably, non-store retailers, i.e. internet sellers, were unchanged in January: the first time this series has not grown M/M in years.

"We took shelter in Netflix"

This time around, there will be panic...

"It wouldn't have been what I would do. I think it's a very bold thing to kind of throw a little bit more lighter fluid on a fire that was already going,"

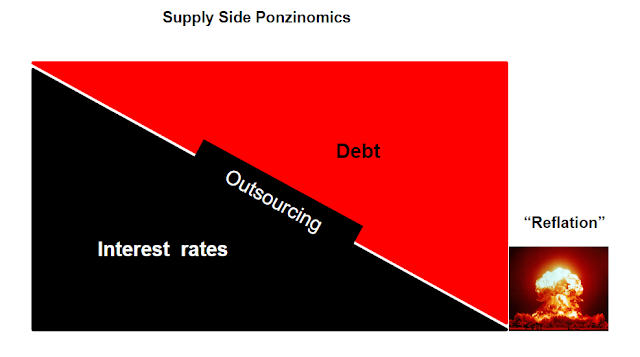

Unfortunately, the U.S. can no longer afford reflation. But you can't tell that to frat boys...

"The Trump administration is looking for the economy to expand even more than it has been, and if that is the case people will earn more money and pay more taxes, making the case for supply-side economics, Blankfein said."