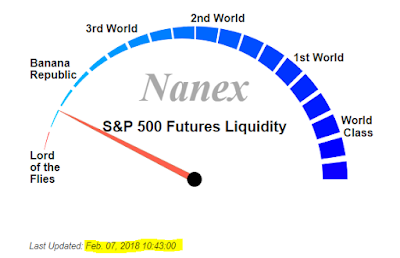

Compliments of rampant 'BTFD', liquidity has improved today. Any questions?

The steepest rallies are in bear markets. Normally the S&P doesn't gain 5.5% in two days:

In a bull market, all news is construed as "good news", whereas in a bear market all news is construed as "bad news". But don't take my word from it, straight from the con-man-in-chief. When he says "the old days", he means two weeks ago:

In other words, *normally* markets begin to price in recession ahead of the onset of recession. Meaning that all recessions are backdated. In this cycle of course, rampant Central Bank manipulation and Trump's tax cut ensured that no "pricing in" of end-of-cycle risk occurred ahead of time. Hence the elevator ride lower. The fact that *good* news is no longer construed as good news is further indication that social mood is rolling over hard. And fast.

This will be the first time in U.S. history the market crashed concurrent with the onset of recession.

The difference can be seen below with mutual fund cash balances. In the two prior cycles, the bulk of the market decline occurred after cash balances had already increased:

Markets send warnings ahead of time, but if there are only corrupt industry whores and zombies at the other end of the line, then those warnings are ignored.

"As the chart shows, that ratio is currently saying the risk is much higher right now for big caps than for small. The Daily Shot calls that “highly unusual.”"