What we are witnessing in real-time is the largest mass psychosis in human history, under the narcotic influence of "greed"...

Right now, rapacious con men are gathered in Davos figuring out exactly how to continue exploiting the sheeple while at the same time stave off rioting. No, they don't see it coming. Hedge fund managers are not bright people, they're groupthink dunces. Just like everyone else:

Global risk appetite is the highest on record

Global stocks are record overbought

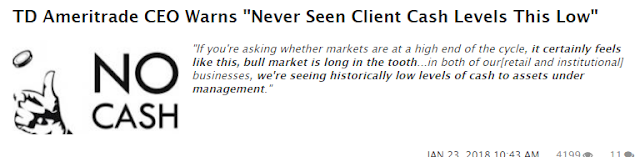

Cash balances record low

Hedge fund billionaire Ray Dalio:

"There's plenty more dumb money to come. Anyone who doesn't get in now will look stupid"

"Groupthink is a psychological phenomenon that occurs within a group of people in which the desire for harmony or conformity in the group results in an irrational or dysfunctional decision-making outcome. Group members try to minimize conflict and reach a consensus decision without critical evaluation of alternative viewpoints by actively suppressing dissenting viewpoints...The dysfunctional group dynamics of the "ingroup" produces an "illusion of invulnerability"

7.5 billion dunces (+/-) think this is the beginning, but it happens to be the end. Human history's largest case of groupthink. In finance it's called "talking your own book" - always assuming there's a bigger dumbfuck to be found, only to learn that the last dumbfuck WAS found...

Supply Side Ponzinomics is coming to its logical sad conclusion; but slum dog billunaires don't see their Ponzi party ending. The cure for epic wealth inequality is epic wealth inequality. That's not a political statement, that's a statement grounded in economic and financial reality. The global experiment in maximum greed was taken to its logical self-destructing conclusion. A society cannot exist solely for mass consumption and rapacious wealth accumulation. The global perpetual growth paradigm has run into the brick wall of a finite planet. The recycled debt inflated corporate profits which underlie billunaire wealth are as ephemeral as the stock prices being bid up with depleted cash balances, strictly out of rapacious FOMOP: Fear of Missing Out On Ponzi...

Right now, rapacious con men are gathered in Davos figuring out exactly how to continue exploiting the sheeple while at the same time stave off rioting. No, they don't see it coming. Hedge fund managers are not bright people, they're groupthink dunces. Just like everyone else:

Global risk appetite is the highest on record

Global stocks are record overbought

Cash balances record low

Hedge fund billionaire Ray Dalio:

"There's plenty more dumb money to come. Anyone who doesn't get in now will look stupid"

"Groupthink is a psychological phenomenon that occurs within a group of people in which the desire for harmony or conformity in the group results in an irrational or dysfunctional decision-making outcome. Group members try to minimize conflict and reach a consensus decision without critical evaluation of alternative viewpoints by actively suppressing dissenting viewpoints...The dysfunctional group dynamics of the "ingroup" produces an "illusion of invulnerability"

7.5 billion dunces (+/-) think this is the beginning, but it happens to be the end. Human history's largest case of groupthink. In finance it's called "talking your own book" - always assuming there's a bigger dumbfuck to be found, only to learn that the last dumbfuck WAS found...

Supply Side Ponzinomics is coming to its logical sad conclusion; but slum dog billunaires don't see their Ponzi party ending. The cure for epic wealth inequality is epic wealth inequality. That's not a political statement, that's a statement grounded in economic and financial reality. The global experiment in maximum greed was taken to its logical self-destructing conclusion. A society cannot exist solely for mass consumption and rapacious wealth accumulation. The global perpetual growth paradigm has run into the brick wall of a finite planet. The recycled debt inflated corporate profits which underlie billunaire wealth are as ephemeral as the stock prices being bid up with depleted cash balances, strictly out of rapacious FOMOP: Fear of Missing Out On Ponzi...

"More than a billion people have been lifted out of extreme poverty — defined as living on $1.90 a day or less — since 1990, according to the World Bank, a dramatic improvement"

They set the original bar at $1.25 in 1990, then moved it up 25 years later, 2015, to $1.90. In other words the global poverty "bar" moved up by the rate of inflation. Keeping it pinned to the dirt was their way of evidencing "dramatic improvement" in poverty reduction. Anyone above that level is now deemed "out of poverty". When World Bank members are forced to live on $2/day no one will be talking about "dramatic improvement". Especially not those godless fucktards.

Where was I...

All denialistic problems come with their own solutions. Because just as Supply Side economics destroyed the labour market, now it will destroy Ponzi capital. They make no connection between growing poverty and growing insolvency even as their tax cut drives interest rates ever higher. Today's slumdog billunaires are so oblivious and clueless that one wonders how they became wealthy in the first place - oh right, bailouts and printed money. Even as they evince "concern" for inequality - in the face of their latest tax cut, they in no way see an end to their Ponzi party.

Take Ray Dalio for example, he sees no endogenous reason why the party would end:

"Billionaire Ray Dalio, a hedge fund manager, has been warning that a “big squeeze”on the middle class is coming as more blue-collar jobs disappear, the population ages and the social safety net cannot keep up. He predicts the already fragile “bottom 60 percent” will be devastated"

But then he says this:

"There is a lot of cash on the sidelines. ... We're going to be inundated with cash," he said. "If you're holding cash, you're going to feel pretty stupid."

This just in:

MACD measures price momentum. MACD 1,50 is the distance between the current price and the 50 dma:

Ray Dalio:

"we will see "a market blow-off" rally, fueled by cash from banks, corporations and investors."

"Get in now, there are more dunces just like you to come"

The Ponzi reflation trade is over