But don't take my word for it...

"This means everything to them"

I'm counting on it.

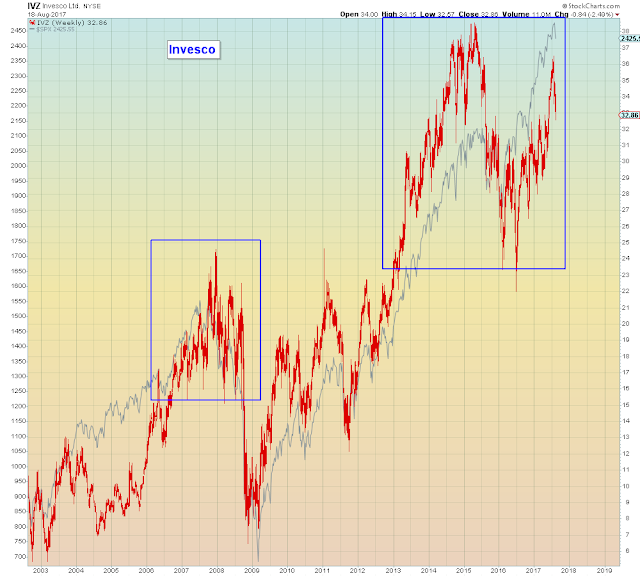

This investment advisory firm put their own stock as the largest holding in their High Beta ETF. You can't make this shit up.

"Then my trusted advisor told me to 'go all in' on reflation"

"The University of Michigan’s sentiment index climbed to 97.6 in August from 93.4 in July, sitting just below a 98.5 reading in January that marked a 13-year high"

Retail stocks -3.7% for the week, back to 2013 levels:

Eyes closed, one would think that this week in the casino was identical to last week - hard down on Thursday, Skynet stick save Friday. Were it not for the burnt offering of Steve Bannon, things may have turned out differently today. In the event significant technical damage was inflicted this week:

This week summarized:

"Goodbye"

The Nasdaq 100 carved out its third lower high, ending the week essentially unchanged, as risk got bought all over again:

Because we know how bullish that is:

The S&P 500 closed below the 50 dma for the second week in a row:

Were it not for the perpetual promise of imminent tax cuts, gamblers would have deserted the casino long ago. In the event they've decided to go down with the ship of fools:

This past week's round-trip monetized the last few hedges:

A few select bellwethers:

Exxon

Skynet is running out of dumbfucks to play with...