The attention deficit Idiocracy doesn't trust reality, but they trust sociopathic liars with everything...

Donny Trump has taken hyperbolic bullshit to level '11' as his words and deeds have gone in opposite direction. Nevertheless, fake-believe in the recovery and the casino remains pinned at record highs. Recall, back in 2011, it was the debt ceiling that caused the wheels to come off the bus, and now the debt ceiling is an issue again at the end of September. September is also when the Fed is expected to announce details around tapering the balance sheet.

All of which means that the U.S. is the global weak link. But don't take my word for it:

The U.S. Dollar Is Weakest in 32 Years

So while Trump is blowing smoke up everyone's ass while approaching another debt ceiling crisis, the Fed is doing their part to engineer recession via Quantitative Tightening:

But wait, there's more...

Let's not forget OPEC's hyperbolic bullshit which has been going on for two years now.

Which means a) that OPEC are price takers and b) that oil is trading entirely technically, based upon overbought and oversold support/resistance levels

And which also means that the latest stage Emerging Markets rally is in the latest stages:

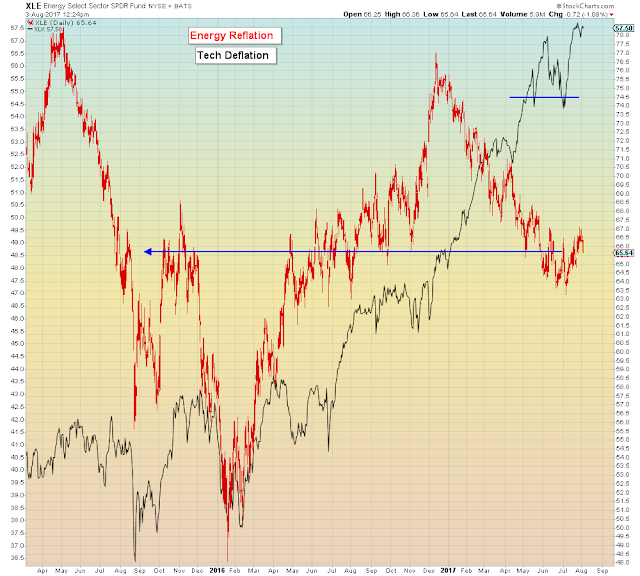

Energy gamblers are losing patience...

Tech gamblers have tested support ~9 times

Bank gamblers are losing patience for the king on his golden throne...

Small cap/junk stock gamblers are out the door already...

Can the old age home watch the exact same movie in six years and not remember the ending?

Six weeks more like it...