The more bad news comes out, the more volatility gets sold. Because monetizing fear is the last asset class, what else?

Quantitative Uneasing is the latest "good" bad news:

And word that the Fed sees an asset bubble, is good for a new all time high, what else?

ZH: Fed Warns Elevated Asset Prices Pose Risk To Financial Stability

It's called selling insurance with the house on fire...

Very similar to how it was in 2007/08 - buyers of protection are getting crushed by the tsunami of capital selling protection. Even as underlying fundamentals deteriorate, the price of "insurance" be it credit default swaps, or in this era volatility, ironically keeps going down. The tail is wagging the dog.

Some of us have seen this movie before...

And then one day, it all goes in reverse and never looks back. At that point the sellers of protection realize they've put far too much capital at risk in the name of short-term P&L. Next they unfortunately realize that "dynamic hedging", is a marketing term, because no such thing exists in a down market run by machines. All it will do is accelerate the collapse into a one-sided market.

Stop me any time...

Stocks are "highly priced now, which means I don't expect them to outperform so much...But for a long-term investor and most people are, I think there should be a place for stocks in the portfolio and they could go up a lot from where they are now ... they could also go down."

Thank you for that asinine segue...

Then the PhDs of the day will realize that they put people into the casino at the edge of collapse. That casino prices can move in the opposite direction from the economy for so long, and then they snap back to join reality.

At which point the underwear shall be mighty stained.

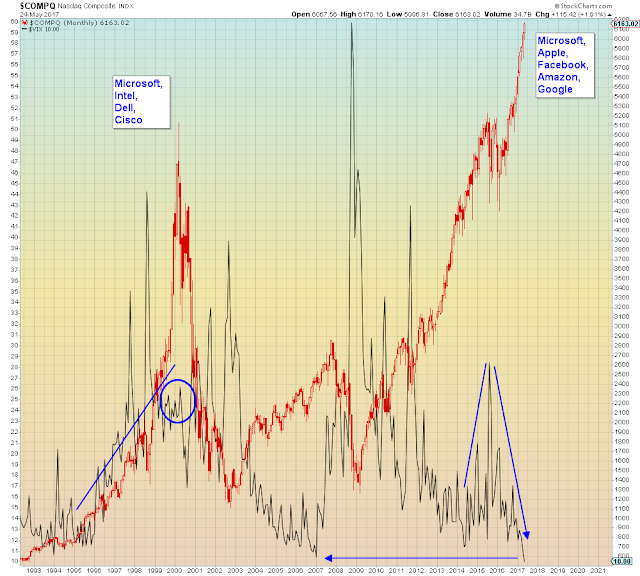

"As long as you only own these five stocks, there's no need to hedge"

"Why didn't you tell me that sooner?"

NOTE: The Nasdaq did not make a new high today, but it did finally climb back to the same level as last week: