Way back last Fall prior to the election, the deflation trade was on in full force. Big Cap Tech was leading along with high yielding Consumer Staples stocks. When Trump got elected, those sectors got tossed aside in favour of economically-sensitive cyclicals: Financials, Energy, Resources, Transports etc. etc.. However, when those got pumped and dumped, gamblers fell in love with Big Cap Tech again. And then those stocks had a violent reversal two weeks ago.

So now it's all about diapers and dish soap - things to buy in a recession. In other words, absolutely nothing has changed since the election. Except...gamblers went ALL IN...

Bueller?

November 2015...

The dollar had a no good very bad day

$USD ETF:

Here is the S&P / Yen ratio showing the power of Magical Thinking, as applied to overnight carry trades:

As indicated above, Consumer Staples took the baton pass from Big Cap tech, which looks like this:

QQQ/XLP

Herein lies the problem: Bonds are now outperforming Consumer staples. Meaning that the REAL recession trade is now on...

XLP / TLT

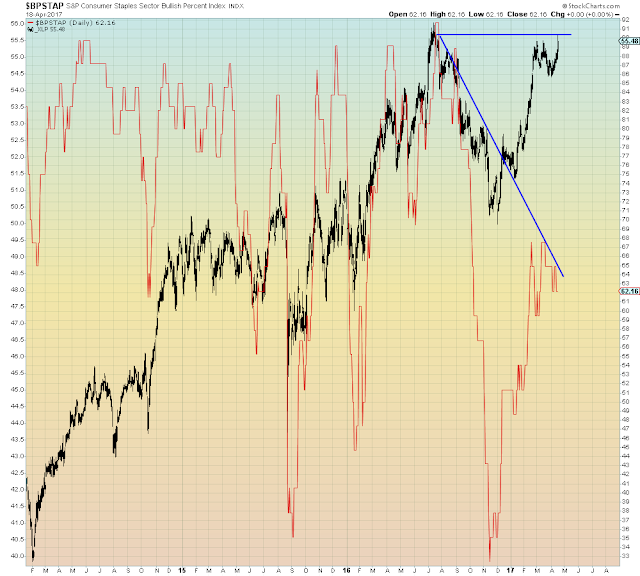

And Consumer Staples % bullish, is not that bullish:

Which means that we've seen this movie before - the one with the reflationary intermission. And unlike some people, I don't pay twice to see the same movie...

Not to be remiss, other things to buy in a recession: Tomahawk missiles, military blunders...

Deja Vu 2002: "Well, let's see, where else can we invade?"

$USD

Deja Vu 2002: "Well, let's see, where else can we invade?"

$USD