Globalization got monkey hammered real good in 2008, but it's this late stage "reflationary" fantasy that is the final nail in the coffin. The only business model now is competitive exploitation of everything and everyone...

The story with Oil and every other industry was over-investment of 0% poverty capital leading to oversupply, glut, and now historic writeoffs...

Exxon Mobil Corp. disclosed the deepest reserves cut in its modern history as prolonged routs in oil and natural gas markets erased the value of a $16 billion oil-sands investment and other North American assets.

The revisions were triggered when low energy prices made it mathematically impossible to profitably harvest those fields within five years. The sprawling, 3.5-billion barrel Kearl oil-sands development in western Canada accounted for most of the hit...The 19 percent drop amounts to the largest annual cut since at least the 1999 merger that created the company in its modern form...The previous record cut was a 3 percent reduction taken during the height of the global financial crisis in 2008. The reserves are now at their lowest since 1997.

Here is what happened to Oil...

Oil peaked in 2008 at ~$150 per barrel then crashed during the Global financial crisis. The low prices caused demand to reflate, clearing the inventories and allowing prices to rebound. The rebound in prices led to the shale oil revolution, and untold trillions in global investment.

Then in 2014, the Fed took away the punch bowl, which monkey hammered Emerging Markets, Oil, and China...

Chinese FX reserves (red), Fed balance sheet (green), Oil (black):

Dollar strength (green), shellacked Oil and China:

Low oil prices exacerbated the glut...

Oil inventories (green):

Oil inventories (green):

What the Fed and Trump are doing now is finishing the job...

"No need for any of this anymore"

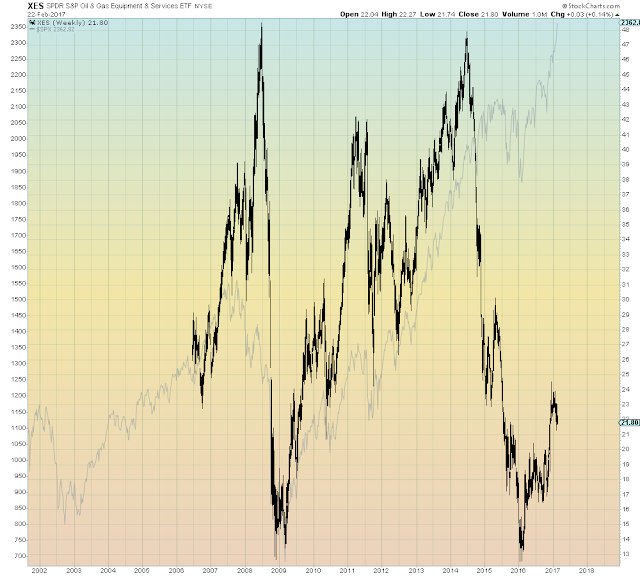

Oil services and equipment: