Risk has never been higher. Complacency has never been higher. Industry capture and performance anxiety assures that most active managers much less home gamers, will never see it coming...

Bueller?

The level of index hedging has collapsed since the election:

Index put/call...

The Dow is the least speculative index, it includes 30 of the largest cap blue chip stocks: The largest banks, the largest tech companies and the largest industrials. Hence using the Dow as a baseline, I charted the S&P (red), Russell 2000 small cap (blue), and the Micro cap junk index (green). Not only do we see high risk appetite as seen in late 2008, in addition, each of the indices is already rolling over relative to the Dow. Which confirms that junk stocks, small banks, retail, and speculative energy are all lagging the blue chip Dow...

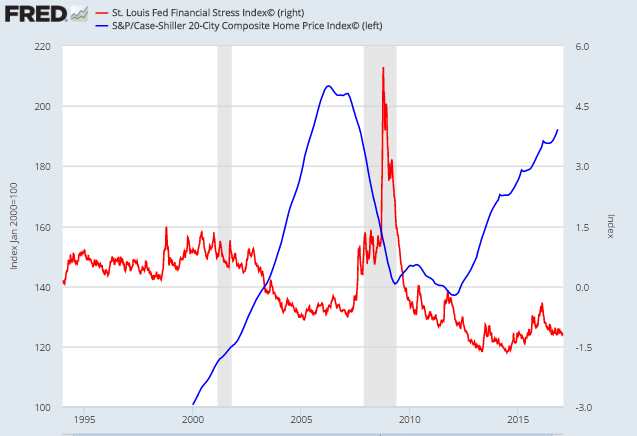

In addition, deja vu of 2008, the St. Louis Fed Financial Stress Index indicates a low level of risk. Because contrary to the Efficient Market Hypothesis, risk is priced the lowest at market tops and the highest at market bottoms.

Financial Stress Index with Case-Shiller Housing Index

No, the Idiocracy never learns:

Meanwhile, inflation is running hot according to this morning's release. However, some of us, albeit not many, have seen this movie before. Both the CPI and PPI rose by the same amount (.6%) in January...

Here is the PPI-CPI (as of Dec. 1st, 2016):

CPI with Canadian Dollar

Carl Icahn's hedge fund is re-imploding

The chase is on... Hedge fund performance relative to S&P 500:

The latest retail casualty

Fossil watches and jewelry

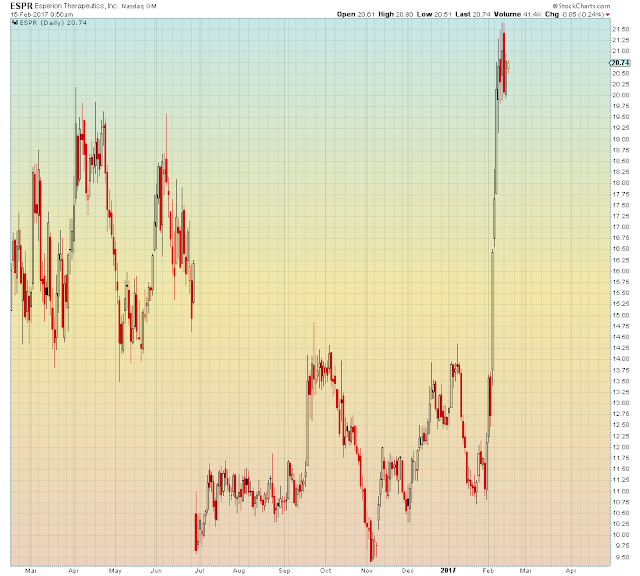

Add Biotech to the list of "disciplined speculative" junk that has doubled in the past two weeks:

Watch out for that fake news though...

The above stock was the top performing IPO of 2015:

Schwab with the IPO mutual fund