Fake news, fake leaders, fake recovery, fake 'Conomy, fake people. Conning an entire planet of corporate bukkake whores is not that difficult. Because nothing lies as much as over-committed capital, and the corrupt buffoons managing it...

On a dollar adjusted basis no other stock market in the entire world is near all time highs. On an inflation/debt adjusted basis, the Dow is in 1998. In other words this is all just a colossal Ponzi scheme to the benefit of fewer and fewer people, now featuring eight bailed out billunaires who have more fake wealth than half the world. Make that seven...

Gene Epstein again, EconoDunce extraordinaire:

"The Dow hitting 20,000 was no fluke. Today’s stock prices are well supported by solid prospects for corporate earnings and economic growth"

This is the S&P 500 Wall Street's benchmark:

Tops are a "process" followed by the shitting of bricks...

Meanwhile, due to overwhelmingly pervasive belief in the fake recovery which was outsourced to China until they lost it too - the Fed and Trump have been tightening U.S. monetary policy. This has had the effect of sucking capital out of the entire rest of the world.

Good job, you just imploded Globalization

Global bond yields:

At the same time they have caused quantitative tightening in the U.S. at the end of the cycle. The Fed has never tightened this late in the cycle previously.

U.S. payrolls (red) with log scale Fed Rate:

Trump monkey hammered Emerging markets:

Emerging markets are now making their fifth lower high in this cycle. Each rally is of shorter and shorter duration. The set-up looks like 2011, or more likely 2008, but it's actually 2017...

Which means that markets are one tiny RISK OFF event away from global capital getting sucked back out of the U.S., post haste...

USDJPY

Which will trigger the U.S. stock/bond rebalancing and hence the cascading Ponzi collapse...

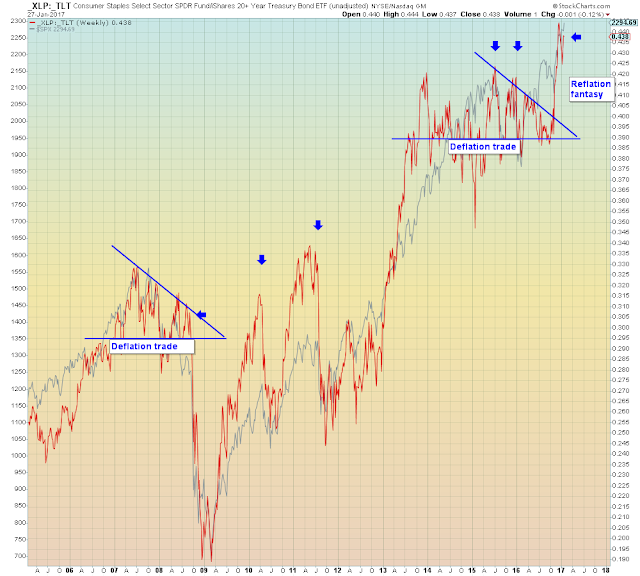

High dividend stocks peaked last summer...

The Nasdaq 100 / Dow crash ratio

Money (Out)flow

In other words, Emerging Markets now determine the fate of the Dow:

Final detonation sequence began this week...

Nasdaq 100 with % of stocks above 200 dma:

"Today’s stock prices are well supported by solid prospects for corporate earnings and economic growth"

S&P earnings yield with Global GDP