"Get me in to the Hotel Californication"

ETFs saw a whopping $49.1 billion in inflows, the highest monthly total ever in records going back to 1998, according to State Street Global Advisors.

"While the jury is clearly still out on President-elect Trump's decree to make America great again, as he has yet to take office, the post-election fervor has certainly made U.S.-based fund flows great again,"

Last night:

Goldman Sachs and JP Morgan...

JnJ

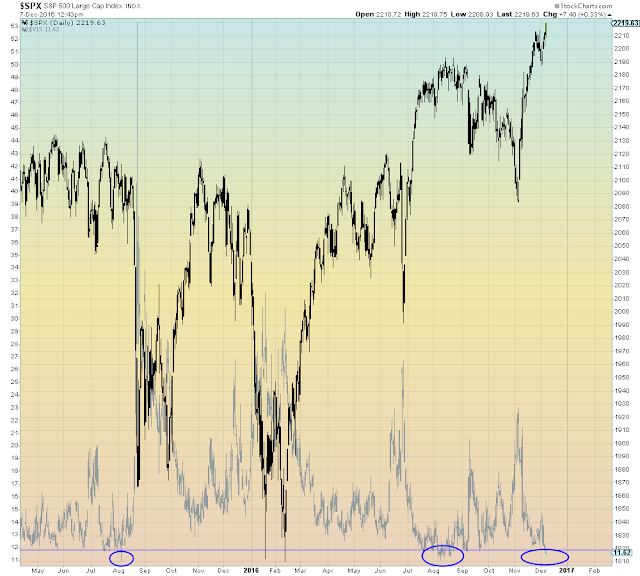

% of S&P above 200 dma:

Money (Out)flow

Regardless of how much money is coming into U.S. stocks, someone has to sell, money flow measures the extent to which prices are rising (or falling) in relation to volume:

Despite the heavy fund inflows, prices are mostly falling relative to volume...

On balance volume

VIX Complacency

Hedge fund performance gap relative to S&P 500:

i.e. who is buying record futures...