Globalization's leaders are the biggest bunch of intellectually stunted dullards in human history without any comparison. They're all empty shirts and sociopathic posers. Donald Trump is the tip of the ice berg...

The article basically indicates that subprime borrowers are in better shape than "super prime" borrowers, because they are less leveraged:

"There is an assumption that those with better incomes and good credit ratings are in good financial shape...That's not the case at all. They're biting off more than they can chew."

Monetary Policy Subsidizes Bankruptcy. Debt Is Not “GDP”

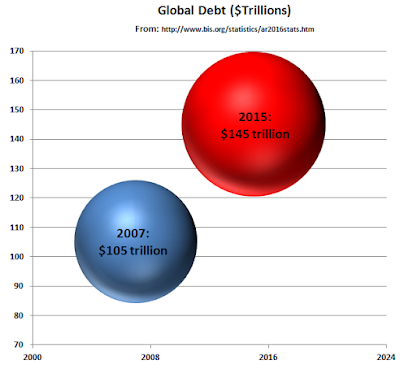

Monetary policy “works” by lowering the cost of capital, subsidizing debt accumulation. Debt used for investment purposes is self-funding to the extent that it creates a stream of future cash flows that can be used to pay off the debt. Debt used for consumption is not self-funding and worse, it creates an artificially inflated baseline of consumption without any assurance of future payoff. Consumer debt is merely pulling forward consumption from the future, which on an aggregate basis inflates current period GDP at the expense of future GDP. In other words, it’s a political gimmick, with disastrous downstream effects. Because debts having durations longer than one business cycle e.g. mortgages, amplify the destructive effects of economic downturns, as overleveraged consumers struggle to meet their payments amid declining incomes. The prime example of debt leading to accelerated collapse was the U.S. Housing Bubble. Following 9/11, the Greenspan Fed lowered interest rates to 1% which sparked a massive consumption binge. The historically cheap money soon found its way into the housing market amid widely heralded “financial innovation” such as teaser rates, adjustable rate mortgages with massive interest rate resets, and other gimmicks to artificially make homes seem initially more affordable. Once these gimmicks had been widely adopted, the Fed subsequently raised interest rates 17 times from 1% to 5%, obliterating homeowners. The bottom line is that Monetary Policy to encourage investment in an otherwise moribund economy makes sense as long as it doesn’t contribute to overinvestment, zero sum speculation, and asset bubbles. However, Monetary Policy to encourage consumption is a zero sum game, robbing the future for the benefit of the present. It’s a political gimmick which accentuates recoveries during the period of one political/business cycle, leading to leveraged crashes, foreclosures, bankruptcies, and mass poverty.

Fed Funds rate with U.S. home prices (red):

Consumption pull-forward

New home sales (red) with U.S. population (blue):

"Then we borrowed our way out of a debt crisis by following the same sociopaths who created the last one"