Central Banks have conned zombies into taking maximum risk at the end of the cycle...

Maximum Risk Visualized

Nasdaq 100 broadening top:

"It is a common saying that smart money is out of market in such formation and market is out of control. In its formation, most of the selling is completed in the early stage by big players and the participation is from general public in the later stage."

On the one hand, the carry trade says it's 1997/'98 all over again...

Global Financials are more in line with 2008:

The NYSE Composite is reminiscent of late cycle Y2K:

Something bulltards never want to see:

Nvidia, Lockheed Martin and JnJ confirming BOTH the late cycle Y2K/2008 scenarios at the same time:

The drawdown in Rydex risk assets confirms the late cycle hypothesis...

Growth / value ratio, same:

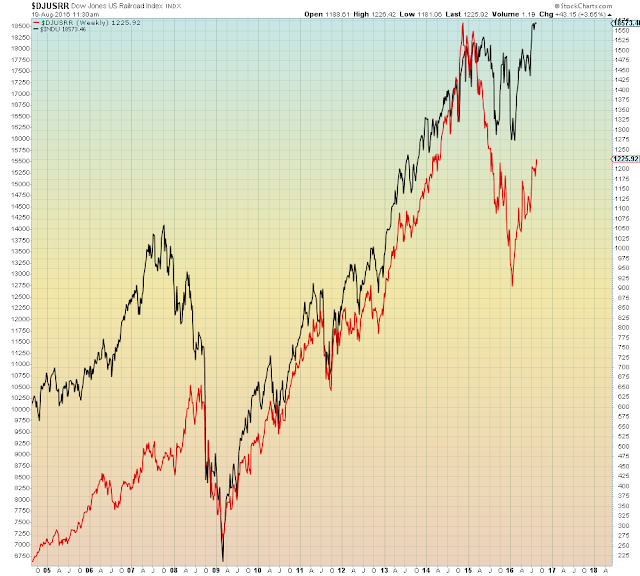

Railroads aka. Mega Dow Theory Non-confirmation:

Consumer staples with Global GDP. Late cycle 2008:

Nasdaq / Utilities ratio

Retail

Money (Out) Flow

Consumer staples with Global GDP. Late cycle 2008:

Nasdaq / Utilities ratio

Retail

Money (Out) Flow