The better than expected jobless report was another excuse to lunge for the all time highs in the S&P 500...

Somehow we are to believe that the U.S. economy added 11,000 jobs in May and 287,000 in June:

BBG June 8, 2015

On another note, someone else has noticed the "Overnight risk" imported from overseas markets, and considers it bullish, what else?

MW July 8, 2016

aka. SPY GAPS

Over the last four months, as you can see, it on average lost ground during those overnight hours, when trading is dominated by foreign traders. During the day session, in contrast, the S&P produced an average gain that is even larger than the overnight losses.

It’s an open-and-shut case: The stock market’s near-term prospects are good.

Oil versus stocks:

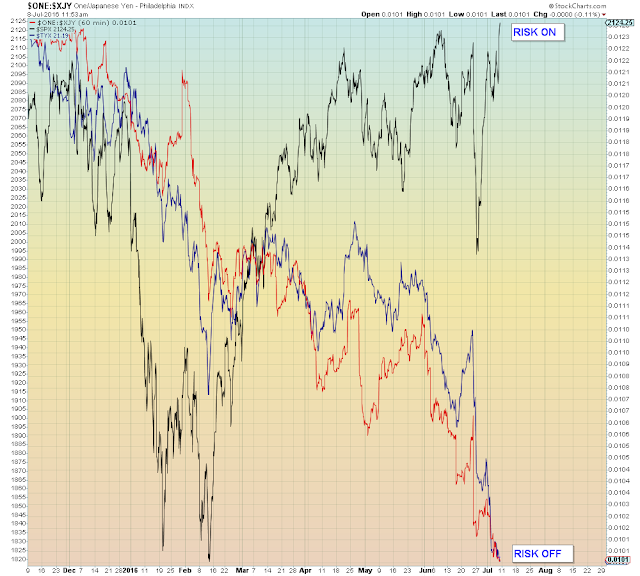

Treasuries and JPY versus stocks

It’s an open-and-shut case: The stock market’s near-term prospects are good.

S&P versus VIX (inverted):