Stunned dullards can't figure out why the VIX jumped so much in the past week despite the small downside move in the S&P 500...Overseas turmoil is being transmitted to the U.S. via the overnight futures, and then of course that gap risk is getting bought during the day session giving the appearance of a market that hasn't moved much...

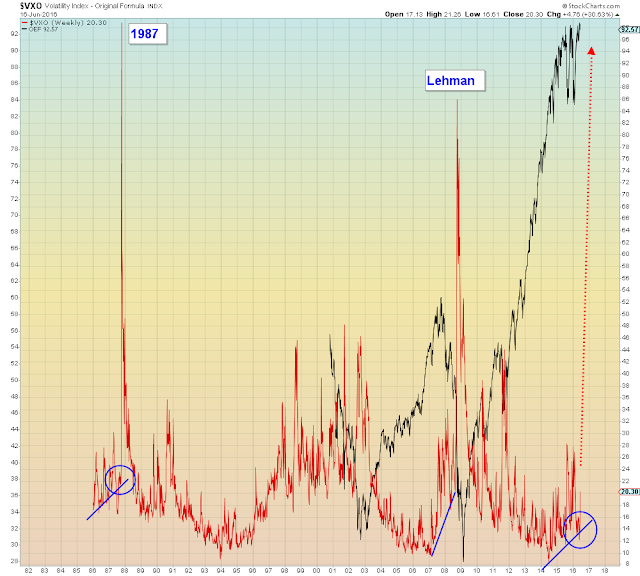

S&P downside gaps (red) with VIX:

One year view, 6 dma

S&P downside gaps with S&P:

10 year view, 30 dma.

The circled number right is the current one day reading (10 S&P point gap on Thursday)

S&P gaps with World ex-U.S.:

Mind the gap

Mind the gap 'n crap

"The rest of the world is fucked, but we're going to make a lot of money"

"Going into next week, going into Brexit, you are set-up for an upside breakout in the S&P 500..."

http://video.cnbc.com/gallery/?video=3000526589

There's no way out of the Hotel Californication