The Federal Reserve was the last Central Bank to capitulate. Yesterday...Don't tell that to the stoned Idiocracy, they're still trying to monetize poverty at 0%:

"The USDJPY just broke its 200 week moving average, and the last time that happened in 2007, it was a good time to be a seller of just about everything...but, this time it means upside breakout in the S&P 500"

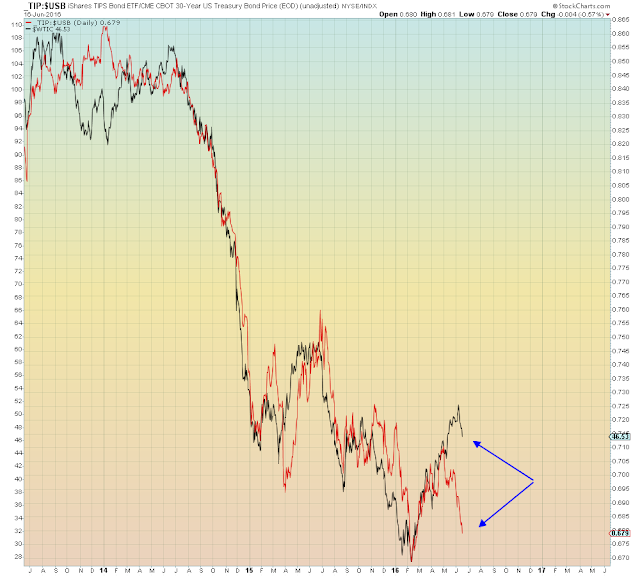

Brexit is obscuring the fact that this entire global sell-off is really all about global synchronized economic slowdown. As indicated by deflation and confirmed by Global stocks, Global Financials, Oil, Yields, carry trades, and China nightly. Oh right, and the Federal Reserve on Wednesday...

Oil with deflation:

Therefore, this is a "bullish divergence". Because what else could it be?

U.S. versus rest of the world

"The German Dax is testing its 200 week moving average...the Nikkei is testing its 200 week moving average...Gold is testing its 200 day from the underside, and the USDJPY just broke its 200 week moving average, and the last time that happened in 2007, it was a good time to be a seller of just about everything. So what does it all mean? Going into next week, going into Brexit, you are set-up for an upside breakout in the S&P 500..."

"Global markets are in free-fall, hence this is clearly a buying opportunity..."

German Dax w/200 week moving average:

Japanese Nikkei