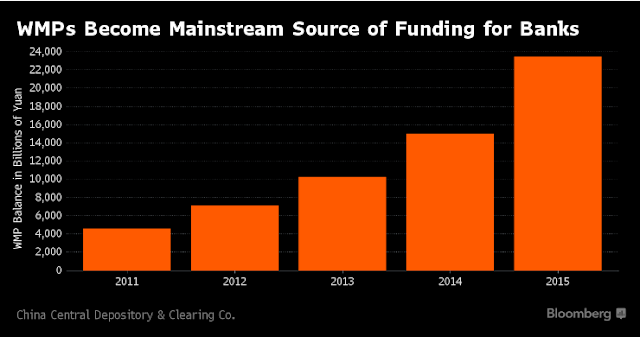

Deja Vu of 2008, securitization is how Chinese banks originate risk and then redistribute that risk into the financial system, all under the guise of reducing risk. Their version of Collateralized Debt Obligations (mezzanine debt) is called Wealth Management Products, "WMPs"...

“We’re starting to see layers of liabilities built upon the same underlying assets, much like we did with subprime asset-backed securities, collateralized debt obligations, and CDOs-squared in the U.S.,” Charlene Chu, a partner at Autonomous who rose to prominence in her former role at Fitch Ratings by warning of the risks of bad debt in China, said in an interview on May 17.

"The risk of a default chain reaction is looming over the $3.6 trillion market for wealth management products in China."

"WMPs, which traditionally funneled money from Chinese individuals into assets from corporate bonds to stocks and derivatives, are now increasingly investing in each other"

This was the entire specious hypothesis behind CDOs circa 2008 - that by packaging disparate risk into a "bundle" that somehow overall risk was lowered. In reality, quite the opposite was occurring as origination standards collapsed since banks no longer held onto the securitized assets. Meanwhile systemic risk was embedded in all subprime mortgages via the economy, the national housing market, and Greenspan's 17 interest rate increases. By the end of course, Goldman had invented the synthetic CDO to package the most highly correlated high yielding subprime which they sold to clients and then bet against using Credit Default Swaps. When that all went sideways due to Lehman, they were bailed out 100% on the dollar by Goldman Alum Hank Paulson and the U.S. taxpayer.

"The industry’s ability to meet its return targets thus far may overstate its stability. The most common source of funds for repayment of WMPs is the issuance of new WMPs...a risk alluded to in 2012 by Xiao Gang, then chairman of Bank of China Ltd., when he warned of “Ponzi scheme” dangers for the industry.

Weapons of Mass Panic 2.0: